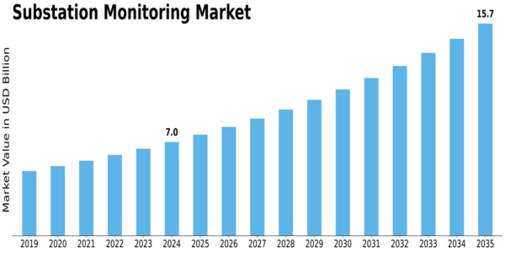

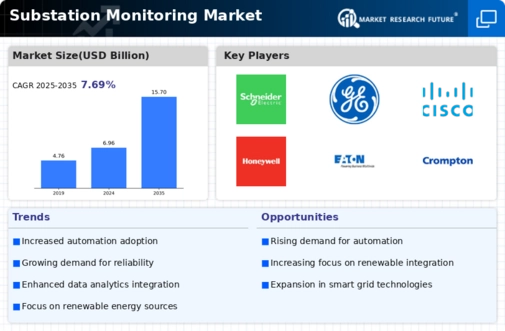

Substation Monitoring Size

Substation Monitoring Market Growth Projections and Opportunities

Rising power consumption, grid dependability, and better monitoring technologies drive the Substation Monitoring market. Electrical networks depend on substations for electricity transmission and distribution. Substation monitoring systems must be efficient and dependable as global energy demand grows. Infrastructure development initiatives, where governments and utilities modernize and extend electrical systems to fulfill residential, commercial, and industrial energy demands, drive market dynamics. Technological advances shape the Substation Monitoring industry. IoT and smart grid technologies are transforming substation monitoring systems with enhanced sensors, communication networks, and data analytics. These upgrades enable utilities to remotely monitor and operate substations in real time, boosting grid resilience, fault response, and maintenance schedules. Grid reliability drives substation monitoring market dynamics. Utility companies are embracing monitoring systems to improve electrical infrastructure dependability to ensure power delivery. Proactive monitoring reduces downtime and improves substation performance by identifying possible faults before they become major failures. This is especially important in areas prone to harsh weather or other environmental issues that might affect the grid. Growing renewable energy integration also affects Substation Monitoring market dynamics. The increase of solar, wind, and other renewable energy sources requires grid power flow monitoring and regulation. Real-time data on energy output, consumption, and grid conditions from substation monitoring devices helps integrate renewable energy. This allows renewable energy to be seamlessly integrated into the electrical grid. Government rules and standards affect Substation Monitoring market dynamics. Regulatory authorities define substation monitoring and control criteria to maintain grid dependability, safety, and environmental compliance. These requirements force market participants to establish industry-standard monitoring systems. Since substations are vital to electrical grid stability, cybersecurity in substation monitoring is developing. Substation Monitoring market dynamics are driven by competition. Industry leaders create new sensors, communication protocols, and data analytics platforms for monitoring. The industry offers simple monitoring systems to complete solutions that use AI and machine learning for predictive maintenance and problem detection.

Leave a Comment