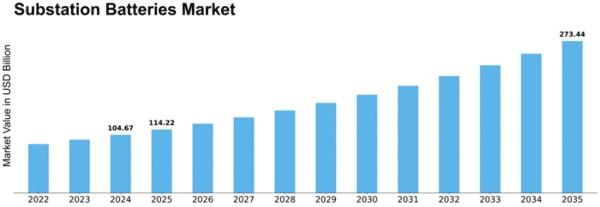

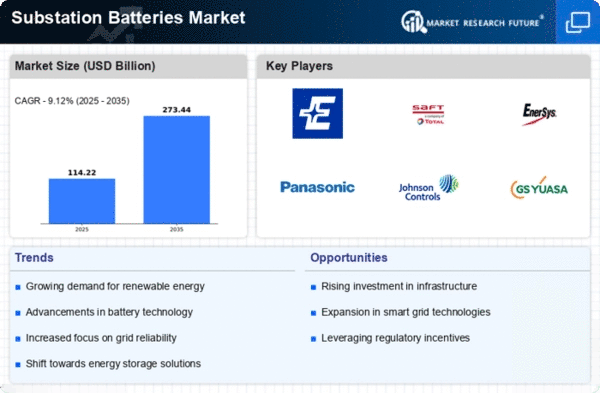

Substation Batteries Size

Substation Batteries Market Growth Projections and Opportunities

The role of the substation batteries’ dynamics in shaping energy infrastructure landscape cannot be overemphasized. Power grids have their most crucial components in the form of substation batteries which provide standby power and stabilize voltage fluctuations. Understanding the market dynamics involves studying a number of issues that affect their demand, supply and technology.

Firstly, there is increasing focus on renewable energy integration which boosts demand for substation batteries. Solar power and wind power are gradually being embraced as alternative sources of powering our homes and industries, thus pushing for reliable storage means for such energies. Sub-station batteries come in handy when it comes to storing excess electricity generated during peak periods to be used at high demand times hence ensuring grid stability.

Moreover, global grid modernization and electrification initiatives are propelling the substation battery market. This has seen governments and utilities invest in upgrading aging infrastructure through incorporation of smart technologies that enhance energy storage capacities. In this regard, manufacturers and suppliers who deal with battery business have an upper hand due to surge energies.

Technological advancements and innovations play a central role in shaping market dynamics. On-going research focuses on improving battery efficiency, life span, safety while cutting costs significantly. Through different chemistries such as lithium-ion or flow batteries plus emerging technologies like solid state ones give more choices for utilities as well as grid operators hence fostering competition.

Furthermore, changing regulatory environment also affects the substation battery market considerably. Policies supporting energy storage deployment; incentives towards grid resilience; mandates encouraging clean energy penetration all affect adoption and deployment into substations respectively. Usually there are favorable regulatory frameworks that facilitate expansion of the markets by attracting many investments within the field of battery storages.

The competitive landscape also plays a crucial role in market dynamics because several established players compete against each other based on price or technology leading to low prices associated with these products/services offered as compared to those offered by new entrants into this industry Moreover, strategic alliances, partnerships and mergers & acquisitions further reshape market dynamics thereby affecting the supply chain plus product offerings.

Leave a Comment