Top Industry Leaders in the Subsea Manifolds Market

*Disclaimer: List of key companies in no particular order

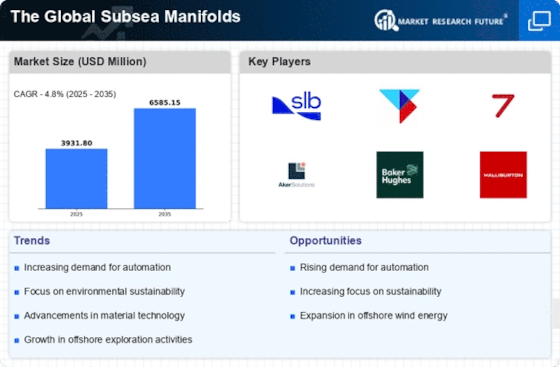

Top listed companies in the Subsea Manifolds industry are:

ABB (Switzerland), Aker Solutions ASA (Norway), Baker Hughes Incorporated (U.S), TechnipFMC Technologies Inc. (U.S.), General Electric (U.S.), and ITT Bornemann GmbH (Germany). One Subsea (U.S.), Subsea 7 S.A. (U.K.), Schlumberger (U.S.), Halliburton (U.S.), Siemens AG (Germany), and Drill Quip (U.S.) are among others.

Navigating the Depths: Competitive Landscape of the Subsea Manifolds Market

The subsea manifolds market, while niche, holds immense strategic importance in the oil and gas (O&G) sector. These complex systems act as underwater junctions, directing the flow of hydrocarbons from various wells to processing facilities. As deep-sea exploration intensifies, the demand for sophisticated and reliable manifolds intensifies, shaping a dynamic competitive landscape.

Key Players and Strategies:

The market boasts established players like Aker Solutions, FMC Technologies, TechnipFMC, GE (Baker Hughes), and Schlumberger, leveraging their extensive experience and global reach. These giants focus on:

Product diversification: Expanding portfolios beyond template manifolds to cater to niche applications like pipeline end manifolds (PLEMs) and cluster manifolds.

Technological innovation: Investing in R&D for materials that withstand harsh deep-sea environments, automation for improved operational efficiency, and digitalization for real-time data monitoring.

Strategic acquisitions and partnerships: Consolidate market share and acquire specialized expertise through targeted acquisitions and collaborations with smaller players or technology providers.

Market Share Analysis:

Analyzing market share in this intricate sphere requires a multi-faceted approach:

Geographical reach: Companies with a strong presence in key O&G hubs like the North Sea, Gulf of Mexico, and Brazil hold an edge.

Portfolio breadth: Offering a diverse range of manifold types and customizations tailored to specific project requirements attracts a wider customer base.

Technological prowess: Demonstrated expertise in advanced materials, automation, and digital solutions can set a company apart.

Track record of successful project execution: A proven history of delivering reliable and efficient manifolds under challenging conditions builds trust and attracts repeat business.

New and Emerging Trends:

The industry is witnessing exciting new trends that reshape the competitive landscape:

Focus on lightweight and corrosion-resistant materials: Advancements in titanium alloys and composites enable lighter, stronger manifolds, reducing installation costs and environmental impact.

Integration of digital twins and real-time monitoring: Digital twins act as virtual replicas of physical manifolds, allowing for predictive maintenance, optimizing performance, and minimizing downtime.

Subsea processing and data acquisition: Integrating processing units within manifolds reduces topside infrastructure needs and enables real-time data acquisition for informed decision-making.

Rise of local players and niche specialists: Regional players with in-depth knowledge of specific geographical challenges and niche specialists offering unique solutions are gaining traction.

Overall Competitive Scenario:

The subsea manifolds market is witnessing fierce competition, driven by rising demand, technological advancements, and regional variations. Established players hold sway with their comprehensive offerings and experience, but smaller players and niche specialists are carving out valuable spaces. Continued innovation in materials, automation, and digitalization will be critical for differentiation and success. Companies that adapt to these trends, demonstrate technological prowess, and build strong partnerships will navigate the depths of this dynamic market and emerge as leaders.

Latest Company Updates:

ABB:

- In September 2023, ABB announced the launch of its next-generation Subsea Power Distribution System (PDS), designed to improve reliability and efficiency in harsh subsea environments. The new PDS features digital technology for enhanced asset monitoring and diagnostics.

Aker Solutions ASA:

- In October 2023, Aker Solutions won a contract from Equinor to deliver a subsea manifold system for the North Field Expansion project in Qatar. The project will involve the development of the world's largest non-associated gas field.

Baker Hughes Incorporated:

- In August 2023, Baker Hughes completed the installation of the world's first all-electric subsea production system in the Bonga field offshore Angola. The system is designed to reduce emissions and improve operational efficiency.

TechnipFMC Technologies Inc.:

- In July 2023, TechnipFMC received an order from TotalEnergies for the supply of subsea equipment, including manifolds, for the Mero 4 project offshore Brazil. The project will develop a pre-salt oil and gas field in the Santos Basin.