- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

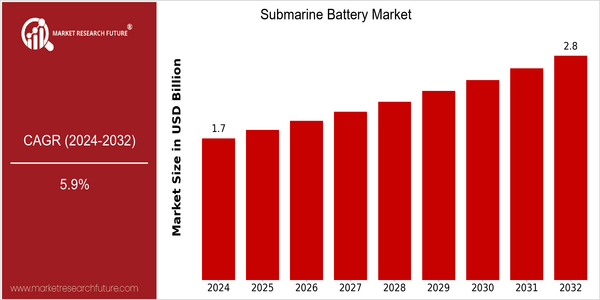

| Year | Value |

|---|---|

| 2024 | USD 1.7 Billion |

| 2032 | USD 2.8 Billion |

| CAGR (2024-2032) | 5.9 % |

Note – Market size depicts the revenue generated over the financial year

The submarine battery market is growing rapidly. In 2024 it will be worth $1.7 billion, and by 2032 it will be worth $2.8 billion. The CAGR over this period is 5.9%. The increasing demand for advanced underwater vehicles and the growing importance of energy efficiency in marine operations are the main factors driving this growth. As nations continue to invest in their naval capabilities and explore the seas, the need for safe and reliable batteries grows. Further growth is being driven by developments in battery chemistry, such as the development of lithium-ion and solid-state batteries. These innovations increase energy density, reduce charging times, and improve performance in the harsh underwater environment. The major players in the submarine battery market, such as Saft Groupe, Panasonic, and Thales, are pursuing strategic initiatives such as collaborations and product launches to strengthen their position. Recent collaborations, for example, to develop the next generation of submarine batteries, demonstrate the industry’s commitment to meeting the evolving demands of underwater applications.

Regional Market Size

Regional Deep Dive

The submarine battery market is experiencing considerable growth in various regions. The major growth drivers of this market are technological advancements, increasing demand for underwater exploration and rising demand for sustainable energy solutions. Each region has its own characteristics influenced by the regulations, technological innovations and economic conditions. The interplay of government initiatives, private investments and environmental concerns has created a diverse picture of opportunities and challenges in the submarine battery market.

Europe

- European countries are leading the charge in developing sustainable submarine battery technologies, with companies like Saab and Thales investing in innovative energy storage solutions that comply with stringent EU environmental regulations.

- The European Union's Green Deal is pushing for a transition to greener technologies, which is influencing submarine manufacturers to adopt more sustainable battery systems, thereby enhancing the market's growth potential.

Asia Pacific

- China's submarine technology is developing rapidly, and the state-owned China Shipbuilding Industry is developing high-capacity batteries for military submarines, which will promote the development of the domestic submarine battery industry.

- Japan's focus on energy security and underwater exploration has led to increased investments in submarine battery technology, with companies like Mitsubishi Heavy Industries exploring new battery chemistries to enhance performance.

Latin America

- Brazil is focusing on enhancing its naval capabilities, with investments in submarine battery technology aimed at improving the operational range and efficiency of its fleet, particularly in the context of protecting its vast maritime resources.

- Regulatory frameworks in Latin America are evolving to support the development of sustainable technologies, encouraging local companies to innovate in the submarine battery space, which could lead to increased competition and market growth.

North America

- The U.S. Navy has made large investments in submarine batteries, and is particularly interested in the use of lithium-ion batteries to improve the operational efficiency and reduce the cost of maintenance. Submarines. This change is expected to increase the performance and life of submarine fleets.

- Recent regulatory changes in the U.S. have emphasized the need for environmentally friendly battery solutions, prompting companies like General Dynamics Electric Boat to explore alternative energy sources and battery recycling initiatives.

Middle East And Africa

- Countries in the Middle East, particularly those with significant naval capabilities like Saudi Arabia, are investing in submarine technology, leading to increased demand for advanced battery systems that can support longer missions.

- In Africa, submarine activity is gradually increasing. South Africa is exploring the possibility of establishing a battery industry in partnership with foreign companies.

Did You Know?

“Did you know that lithium-ion batteries, which are increasingly being used in submarines, can provide up to three times the energy density of traditional lead-acid batteries, significantly enhancing the operational capabilities of underwater vessels?” — International Journal of Naval Architecture and Ocean Engineering

Segmental Market Size

Submarine batteries are a critical part of the marine energy storage market, which is growing steadily in response to the growing demand for underwater operations. Submarine batteries are used to store the energy generated by the electrical equipment of submarines and other underwater vehicles. Submarine batteries are used in submarines, underwater vehicles, submarines, underwater vehicles, underwater vehicles, underwater vehicles, submarines, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, submarines, underwater vehicles, submarines, submarines, submarines, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles, underwater vehicles and other underwater vehicles. Regulations aimed at reducing carbon dioxide emissions are increasing the demand for advanced submarine batteries. Submarine batteries are currently being used in a limited way, with notable advances by Saft and Wartsila, which are leading the way in developing high-performance lithium-ion batteries for submarines. Submarine batteries are used to power underwater vehicles for military operations, scientific missions and underwater construction work. The trend towards sustainable development, the development of batteries, such as solid-state batteries, and the development of energy management systems are driving the growth of this market.

Future Outlook

Submarine batteries are expected to grow at a compound annual growth rate of 5.9 per cent from 2024 to 2032. The demand for advanced underwater vehicles is growing, and the focus on green energy in the naval industry is growing. Submarines are being modernized, and lithium-ion and solid-state batteries are becoming more and more popular. Submarines can be used more efficiently and have a longer mission duration. Technological advances such as increased energy density and faster charging times will drive market penetration. Government policies aimed at reducing CO2 emissions and promoting the use of renewable energy sources will also have a significant impact on the market. Also, the development of hybrid propulsion and the integration of smart battery management systems will further drive the development of submarine batteries. Competition between manufacturers will also increase, which will promote innovation and reduce costs, ultimately benefiting the end users and increasing the strategic capabilities of naval forces around the world.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.90% (2022-2032) |

Submarine Battery Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.