Increased Focus on Data Security

The heightened emphasis on data security is shaping the Storage Class Memory Market. Organizations are increasingly prioritizing secure storage solutions to protect sensitive information from cyber threats. Storage class memory technologies offer enhanced security features, such as encryption and data integrity checks, which are essential for safeguarding data. As regulatory requirements around data protection become more stringent, the demand for secure storage solutions is expected to rise. This trend indicates that storage class memory will be integral in addressing security concerns, thereby driving growth in the Storage Class Memory Market.

Advancements in Memory Technology

Technological advancements in memory solutions are a key driver for the Storage Class Memory Market. Innovations such as 3D NAND and new memory architectures are enhancing the performance and capacity of storage class memory products. These advancements enable faster data retrieval and improved energy efficiency, which are crucial for modern applications. The market is witnessing a shift towards more sophisticated memory technologies that can support the increasing data demands of various sectors. As these technologies continue to evolve, they are likely to attract investment and interest, further stimulating growth within the Storage Class Memory Market.

Expansion of Cloud Computing Services

The ongoing expansion of cloud computing services significantly influences the Storage Class Memory Market. As businesses increasingly migrate their operations to the cloud, the demand for efficient and scalable storage solutions rises. Storage class memory offers the speed and reliability necessary for cloud applications, enabling seamless data access and management. Recent data indicates that the cloud computing market is expected to grow at a remarkable rate, further driving the need for innovative storage solutions. This growth presents an opportunity for storage class memory technologies to establish themselves as a critical component in cloud infrastructure, thereby enhancing the overall performance and efficiency of cloud services.

Integration with Emerging Technologies

The integration of storage class memory with emerging technologies is a significant driver for the Storage Class Memory Market. Technologies such as the Internet of Things (IoT), edge computing, and 5G are creating new opportunities for storage solutions that can handle vast amounts of data with low latency. Storage class memory is well-suited for these applications, providing the necessary speed and efficiency. As these technologies continue to proliferate, the demand for compatible storage solutions is likely to increase, positioning storage class memory as a vital component in the infrastructure of future technological advancements.

Rising Demand for High-Performance Computing

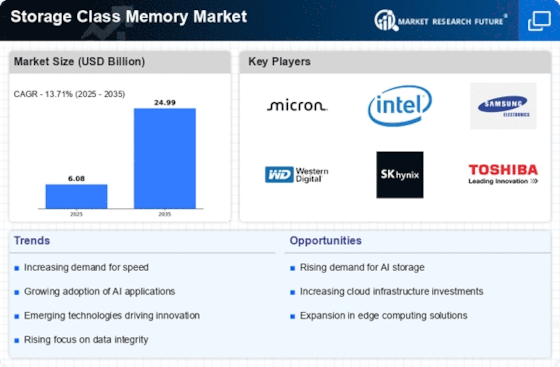

The Storage Class Memory Market is experiencing a surge in demand driven by the increasing need for high-performance computing solutions. Industries such as artificial intelligence, machine learning, and big data analytics require rapid data access and processing capabilities. As organizations strive to enhance their computational power, the adoption of storage class memory technologies becomes essential. According to recent estimates, the market for high-performance computing is projected to reach substantial figures, indicating a robust growth trajectory. This trend suggests that storage class memory will play a pivotal role in meeting the performance requirements of these advanced computing applications, thereby propelling the Storage Class Memory Market forward.