Market Analysis

In-depth Analysis of Sternal Closure Systems Market Industry Landscape

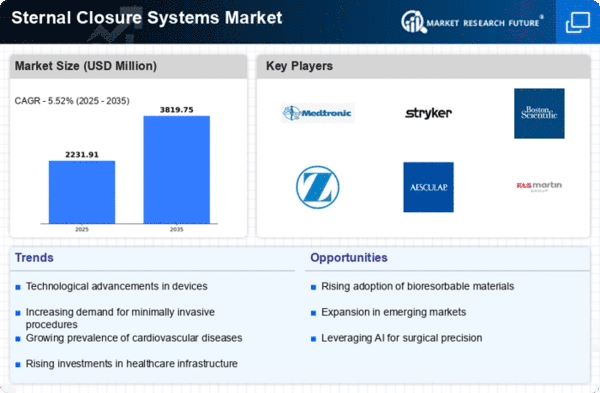

Technological advances, growth in surgical procedures, and the aging population, amongst other factors, are driving the dynamic shifts occurring within the Sternal Closure Systems Market. One of the major causes for this dynamism is the increased prevalence of cardiovascular diseases, which leads to more cardiac surgeries needed to be done on patients affected by these diseases. The increase in lifestyle-based issues along with an aged population results in an exponential rise in cardiovascular disorders, thereby creating robust terminal closure systems markets. These systems play an important role in stabilizing post-surgery sternum, reducing complications and risks, and hence enhancing patient outcomes. Furthermore, technical innovation has helped alter the landscape of sternal closure systems. The effectiveness and safety of these systems have greatly improved through innovations in materials, design, and manufacturing processes. Moreover, market dynamics are further affected by the growing adoption of minimally invasive surgical methods. Sternal closure systems have to adjust to these preferences as surgeons and patients search for less invasive options. Minimally invasive surgeries result in small incisions with low pain levels and faster healing times. Therefore, such procedures call for sternum closing systems that can be used with them; hence, this is increasing demand in the market, thereby prompting companies to invest in R&D for more flexible products. Sternal closure system dynamics have also been influenced by globalization. This has expanded the market reach due to increased access to advanced medical procedures and technologies in developing countries. These regions' demands for sternal closure systems are increasing due to high healthcare awareness levels, rising disposable incomes, and improved healthcare facilities. On a regulatory front, stringent quality and safety standards continue to shape Sternal Closure System markets. Compliance with regulatory guidelines is necessary for manufacturers seeking market approval and building trust among healthcare providers and patients. This regulatory environment encourages constant improvement and innovation and hence acts as a driving force behind the evolution of sternal closure systems.

Leave a Comment