Stereotactic Surgery Devices Size

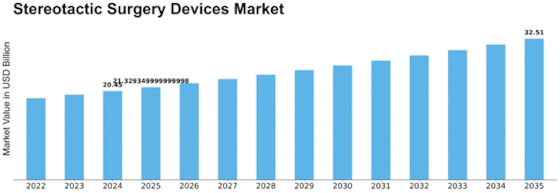

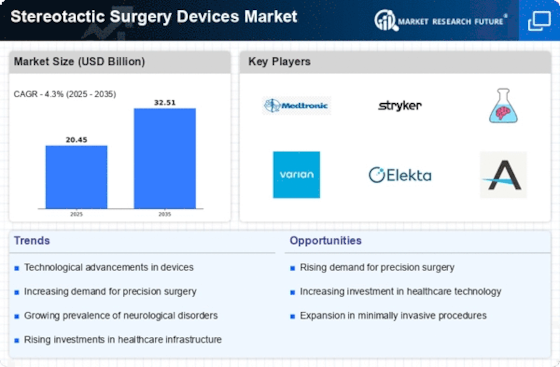

Stereotactic Surgery Devices Market Growth Projections and Opportunities

The stereotactic surgery devices market is influenced by various factors that shape its dynamics and growth trajectory. Firstly, technological advancements play a pivotal role. The evolution of stereotactic surgery techniques and devices has revolutionized the treatment of various neurological and oncological conditions, driving demand for more precise, minimally invasive, and effective surgical interventions. Innovations such as image-guided navigation systems, robotic-assisted platforms, and real-time imaging modalities enhance surgical accuracy, improve patient outcomes, and expand the applicability of stereotactic surgery across a broader range of indications, fueling market growth and competitiveness among manufacturers.

Demographic trends also significantly impact the stereotactic surgery devices market. As the global population ages, there is a rising prevalence of age-related neurological disorders, such as Parkinson's disease, essential tremor, and brain tumors, driving demand for stereotactic surgical interventions. Additionally, the increasing incidence of cancer and the growing adoption of stereotactic radiosurgery as a non-invasive treatment option for brain metastases contribute to market expansion. Moreover, the rise in neurodegenerative diseases and movement disorders underscores the need for innovative stereotactic devices and treatment modalities to address the complex challenges of these conditions.

Economic factors play a crucial role in shaping the stereotactic surgery devices market. The cost-effectiveness and reimbursement landscape influence healthcare providers' adoption decisions and patients' access to stereotactic procedures. Investments in healthcare infrastructure, particularly in emerging markets, drive the adoption of advanced stereotactic technologies and expand market opportunities for device manufacturers. Additionally, healthcare financing mechanisms, insurance coverage policies, and government funding for research and development impact market dynamics and commercialization pathways for stereotactic surgery devices.

Regulatory factors also influence the stereotactic surgery devices market. Stringent regulatory requirements governing the safety, efficacy, and quality of medical devices ensure patient safety and promote innovation in the development of stereotactic technologies. Regulatory pathways for device approvals, including premarket clearance and conformity assessments, influence time-to-market and market entry strategies for manufacturers. Moreover, evolving regulatory frameworks, such as the European Union's Medical Device Regulation (MDR) and the U.S. Food and Drug Administration's (FDA) Digital Health Innovation Action Plan, shape market dynamics and market access for stereotactic devices.

Consumer behavior and healthcare provider preferences contribute to market dynamics in the stereotactic surgery devices market. Increasing patient awareness of minimally invasive treatment options and demand for personalized care drive the adoption of stereotactic procedures for various neurological and oncological conditions. Moreover, healthcare providers' preferences for integrated, user-friendly stereotactic systems that offer seamless workflow integration and comprehensive clinical support influence purchasing decisions and market competitiveness among device manufacturers.

Environmental factors, including technological infrastructure and healthcare delivery systems, also impact the stereotactic surgery devices market. Advances in medical imaging technology, such as magnetic resonance imaging (MRI) and computed tomography (CT), facilitate precise treatment planning and intraoperative navigation in stereotactic surgery, enhancing procedural accuracy and patient safety. Additionally, the availability of specialized healthcare facilities, skilled healthcare professionals, and supportive regulatory frameworks in different regions influence market opportunities and adoption rates of stereotactic surgery devices.

Leave a Comment