Regulatory Frameworks and Policy Support

The Stationary Energy Storage Market is significantly influenced by regulatory frameworks and policy support aimed at promoting energy storage solutions. Governments worldwide are implementing policies that incentivize the adoption of energy storage technologies, recognizing their role in achieving energy security and sustainability goals. For instance, various tax credits, grants, and subsidies are available for both residential and commercial energy storage installations. In 2025, it is anticipated that more than 20 countries will have established comprehensive energy storage policies, fostering a conducive environment for market growth. This regulatory support not only encourages investment in stationary energy storage systems but also enhances public awareness of their benefits, thereby driving demand.

Increasing Electrification of Transportation

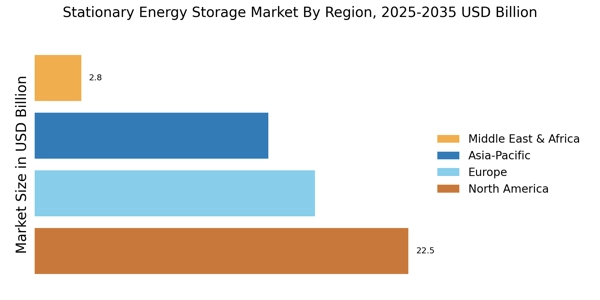

The electrification of transportation is a significant driver for the Stationary Energy Storage Market. As electric vehicles (EVs) gain traction, the demand for charging infrastructure and energy storage solutions is escalating. EVs require substantial energy, and stationary energy storage systems can provide the necessary support for charging stations, particularly during peak demand periods. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million, further intensifying the need for efficient energy storage. Additionally, the synergy between EVs and stationary storage systems can facilitate vehicle-to-grid technologies, allowing EVs to discharge energy back into the grid. This interconnection not only enhances grid resilience but also creates new revenue streams for energy storage providers.

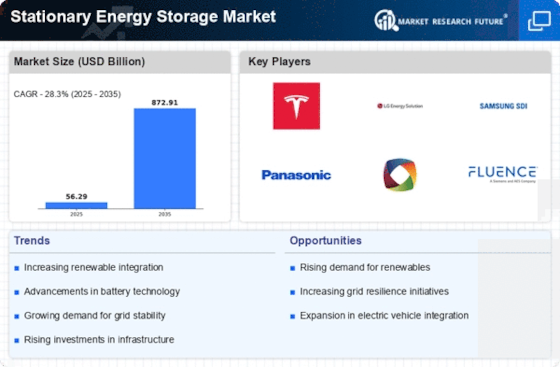

Growing Demand for Renewable Energy Integration

The Stationary Energy Storage Market is increasingly driven by the growing demand for renewable energy sources. As countries strive to meet their renewable energy targets, the need for efficient energy storage solutions becomes paramount. Energy storage systems play a crucial role in balancing supply and demand, particularly with intermittent sources like solar and wind. In 2023, renewable energy accounted for over 30% of the total electricity generation in several regions, highlighting the necessity for robust storage solutions. This trend is expected to continue, with projections indicating that the renewable energy share could reach 50% by 2030. Consequently, the integration of stationary energy storage systems is essential for ensuring grid stability and reliability, thereby propelling market growth.

Technological Innovations in Energy Storage Solutions

The Stationary Energy Storage Market is experiencing a surge in technological innovations that enhance the efficiency and capacity of energy storage systems. Advancements in battery technologies, such as lithium-ion and solid-state batteries, are pivotal in this evolution. These innovations not only improve energy density but also reduce costs, making energy storage more accessible. For instance, the cost of lithium-ion batteries has decreased by approximately 89% since 2010, which has significantly impacted the market dynamics. Furthermore, the integration of artificial intelligence and machine learning in energy management systems is optimizing the performance of storage solutions. This technological progress is likely to drive the adoption of stationary energy storage systems across various sectors, including residential, commercial, and industrial applications.

Rising Energy Costs and Demand for Energy Independence

The Stationary Energy Storage Market is also propelled by rising energy costs and an increasing desire for energy independence among consumers and businesses. As energy prices fluctuate, the appeal of energy storage systems becomes more pronounced, allowing users to store energy during low-cost periods and utilize it during peak pricing times. This capability is particularly attractive for commercial entities seeking to manage operational costs effectively. In 2025, energy prices are projected to rise by approximately 15% in several regions, further incentivizing the adoption of stationary energy storage solutions. Additionally, the quest for energy independence drives investments in local energy generation and storage, reducing reliance on external energy sources. This trend is likely to bolster the stationary energy storage market as more entities seek to enhance their energy resilience.