Top Industry Leaders in the SS7 Market

Competitive Landscape of the SS7 Market

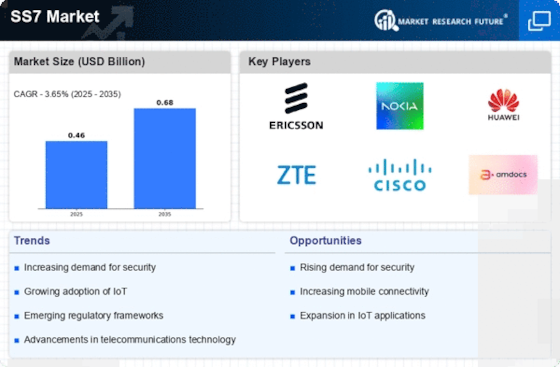

Despite its age, the Signalling System 7 (SS7) market remains a crucial cog in global telecommunications, facilitating core functions like call routing and network management. However, the landscape is rapidly evolving, driven by factors like security vulnerabilities, technological advancements, and the emergence of new players. Understanding this competitive landscape is vital for anyone navigating the SS7 ecosystem.

Key Players:

- Oracle Corporation (US)

- Mitel Networks Corporation (Canada)

- Tieto (Finland)

- Net Number Inc. (Netherlands)

- Ribbon Communications (US)

- Ericsson AB (Sweden)

- Dialogic Corporation (US)

- Huawei Technologies Co. Ltd (China)

- TNS Inc. (US)

- PCCW Global (Hong Kong)

Strategies Adopted:

To maintain their edge, established players are focusing on:

- Security Enhancements: Addressing vulnerabilities through encryption, anomaly detection, and advanced authentication protocols.

- Integration with Next-Gen Technologies: Developing solutions compatible with IP Multimedia Subsystem (IMS) and Voice over IP (VoIP) architectures.

- Cloud-Based Solutions: Leveraging cloud technologies to offer flexible and scalable deployments.

- Managed Services: Providing comprehensive operational and maintenance support for SS7 networks.

Factors for Market Share Analysis:

Assessing market share dynamics requires a multi-faceted approach, considering factors like:

- Geographical Presence: Global reach and brand recognition in key markets.

- Product Portfolio Breadth: Offering a comprehensive range of SS7 solutions catering to diverse needs.

- Technological Innovation: Continuous investment in R&D and development of future-proof solutions.

- Customer Service Excellence: Providing responsive and reliable support to network operators.

- Pricing Strategies: Competitive pricing models tailored to different customer segments.

New and Emerging Companies:

Challenging the established order are smaller, agile companies focused on specific niches. These include:

- Security-Focused Startups: Offering innovative solutions to address SS7 vulnerabilities and compliance challenges.

- Open-Source Solutions Providers: Contributing to the development and deployment of open-source SS7 components.

- Cloud-Native Players: Providing cloud-based SS7 solutions with improved scalability and flexibility.

Current Investment Trends:

Companies are actively investing in areas like:

- Security Solutions: Secure network elements, threat intelligence platforms, and advanced firewalls.

- Network Automation: Tools for automated provisioning, configuration, and optimization of SS7 networks.

- Data Analytics: Solutions for real-time monitoring, anomaly detection, and network optimization based on data insights.

- Interoperability and Standardization: Enabling seamless integration and communication between diverse SS7 implementations.

The SS7 market is expected to remain dynamic, driven by factors like:

- Evolving Regulatory Landscape: Stringent regulations like the NIS Directive in Europe will continue to push for improved security measures.

- Emergence of 5G and IoT: Integration of SS7 with next-generation technologies will create new opportunities.

- Increased Focus on Openness and Interoperability: Open-source solutions and standardized interfaces will pave the way for greater flexibility and innovation.

Latest Company Updates:

February 2023

Delhi Metro has recently launched i-ATS on Red Line. This is an indigenously developed signalling system, the first ever in India. This completely locally made signalling system in fact has been developed jointly by Bharat Electronics Limited and DMRC under the Government of India’s initiatives Aatma Nirbhar and Make in India for the Metro Rail Transit Systems.

India with this milestone is the 6th country entering the elite list of a handfuls of countries within the world with its respective ATS products.

Starting with Red Line, i-ATS System will be deployed further for operations within Delhi Metro’s other forms of operational corridors & the upcoming independent corridors of Phase-4 Project too. Preventive Maintenance modules may also be launched in Phase 4 corridors utilizing i-ATS.

Further, i-ATS can be utilized in operations of the other rail-based systems which also include Indian Railways. The technology is created with the flexibility of working with various signalling vendors. The creation of i-ATS is a noteworthy step towards the growth of an indigenously built communication-based train control (CBTC) based signalling systems for metro railways as the automatic train supervision or ATS is a vital subsystem of CBTC signalling systems. The ATS is system that is computer-based that managed train operations.

It is indispensable for the high-train density operation like the Metro where services get arranged every few minutes. The technology systems like CBTC are controlled primarily by foreign countries. The deployment of the i-ATS will largely decrease the dependency of Indian Metros on the foreign vendors that deal with such technologies.