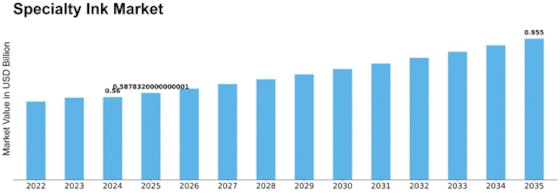

Specialty Ink Size

Specialty Ink Market Growth Projections and Opportunities

The Specialty Ink Market is shaped by a multitude of factors that collectively define its dynamics. Stakeholders in the industry must comprehend these key elements to navigate the market successfully and make informed decisions. Here's an exploration of the primary market factors in a concise, pointer format:

Diverse Applications: The Specialty Ink Market benefits from its diverse applications, spanning various industries such as packaging, textiles, electronics, and promotional products. The versatility of specialty inks contributes to the market's resilience and growth.

Technological Advancements: Ongoing technological advancements in ink formulations and printing technologies drive market growth. Innovations in specialty inks, such as conductive inks for electronics or thermochromic inks for packaging, enhance the market's competitiveness.

Packaging Industry Trends: The packaging industry, with its continuous evolution, is a significant driver for the Specialty Ink Market. Innovations in packaging designs, including the use of specialty inks for security features, brand differentiation, and information displays, impact market trends.

Increased Focus on Branding: Brands are increasingly leveraging specialty inks for unique and eye-catching packaging and promotional materials. The demand for specialty inks is driven by the desire for distinctive branding, holographic effects, and enhanced visual appeal in printed materials.

Digital Printing Growth: The rise of digital printing technologies has a substantial impact on the Specialty Ink Market. Digital printing allows for more customized and variable printing with specialty inks, meeting the growing demand for personalized and short-run printing jobs.

Demand for UV and LED-Curable Inks: The environmental advantages of UV and LED-curable inks, including reduced energy consumption and lower emissions of volatile organic compounds (VOCs), drive their increasing adoption. Specialty inks formulated for these curing methods align with eco-friendly trends.

Consumer Preferences for Sustainable Inks: Growing environmental awareness has led to increased demand for sustainable and eco-friendly ink options. Specialty inks formulated with bio-based or recycled materials cater to consumer preferences for environmentally responsible products.

Regulatory Compliance: Adherence to stringent regulations regarding ink composition, safety, and environmental impact is crucial for specialty ink manufacturers. Compliance with standards such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) ensures market access.

Raw Material Prices: The pricing and availability of raw materials, including pigments and resins, impact the production cost of specialty inks. Fluctuations in raw material prices may influence overall pricing strategies and profitability for manufacturers.

Global Economic Conditions: Economic factors, including GDP growth, consumer spending, and industrial output, impact the demand for specialty inks. Economic downturns may lead to reduced marketing and promotional activities, affecting the market negatively.

Shift towards Water-Based Inks: The industry is witnessing a gradual shift towards water-based inks due to their lower environmental impact and reduced toxicity. Specialty inks formulated with water as a base align with changing preferences for eco-friendly printing solutions.

Increased Demand for Security Inks: The need for anti-counterfeiting and security features in various products, especially in the pharmaceutical and currency sectors, drives the demand for specialty inks with unique properties such as invisible inks and color-changing effects.

Growth in Textile Printing: The specialty ink market experiences growth in textile printing applications, driven by the demand for custom apparel and home textiles. Specialty inks with features like metallic finishes and soft hand feel contribute to the expansion of this segment.

Innovation in Functional Inks: Functional inks, such as conductive inks for printed electronics and 3D printing inks, contribute to market innovation. The development of specialty inks with specific functionalities expands their applications across emerging technologies.

Leave a Comment