Specialty Fuel Additives Size

Specialty Fuel Additives Market Growth Projections and Opportunities

The Specialty Fuel Additives Market is the result of many factors that decide the changing pattern of dynamics and market growth. Among the most important factors is the continually changeable regulatory landscape encompassing fuel quality standards and emissions. The need for purposeful fuel additives has risen in response to a mounting pressure from the governments globally towards environmental conservation and mitigating the effects of global warming. These additives have the habit of assisting fuel economy, cutting out emissions, and meeting up with the rigid environmental standards.

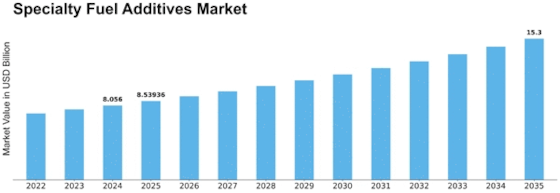

Specialty Fuel Additives Market size has reached 7.2 billion USD in 2022. As per the forecast, the Product of the Specialty Fuel Additives Market is anticipated to expand from USD 7.6 billion in 2023 to USD 12.2 billion by 2032 with a CAGR of 6.0%.

In addition, the global economic trends also have a particularly profound significance on the specialty fuel additives market. Causes such as the volatility of the oil price and economic recessions can alter the behaviour of consumers and the operation of the industry, consequently affecting addicts' demand for fuel additives. In contrast, the times of economic boom contribute to higher production activities and greater fuel purchasing rate among consumers which in turn brings more profits to the niche market of fuel additives. On a related note, the bond between the market and the entire global economic health and stability is maintained.

Technological advancements are a vital part of the Specialty Fuel Additive Market. There are plans for continuous R&D activities whose objectives include the creation of new additives with better performance features. Such efforts propel the industry in terms of growth. The manufacture of more sophisticated compositions of focused problems like engine deposits, corrosion, and fuel stability is something today's industry players has made their driving force. Another aspect of these groundbreaking technologies relates to the efficiency and scale of manufacturing processes which influence market dynamics in this evolving landscape.

The automotive industry, third-party consumer of specialty fuel additives, largely contributes to market tendencies. The growing need for the engine which performs the function well while satisfying the strong regulations for fuel efficiency has facilitated the search for advanced fuel formulations. The specialty fuel additives find their mass usage in gasoline and diesel engines with positive outcomes such as better combustion, less friction, and cleaner exhausts. The transition of the automotive industry that is characterized by the introduction of electric and hybrid vehicles may brings some alteration that will call for flexibility in this sector.

Leave a Comment