Market Trends

Key Emerging Trends in the Specialty Chemicals Market

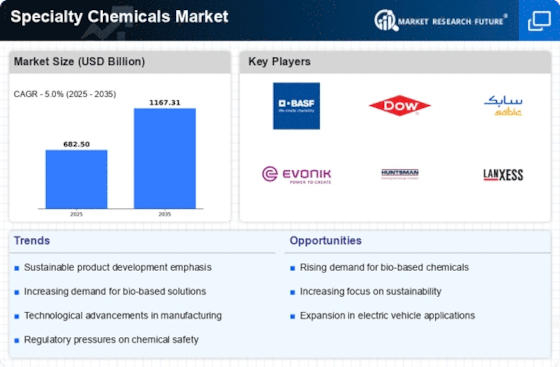

Specialty chemicals include a range of chemicals such as construction chemicals, water treatment chemicals, pulp & paper chemicals, polymer additive, textile chemicals, dyes & pigments, food additive, cosmetics & personal care, and others. These chemicals are used across a broad range of applications, almost in each sector of the chemical industry. Rapid industrialization and urbanization have significantly influenced trade and economies across the globe. On the other hand, consistently growing population and subsequently increasing dependency on textile, food additive, consumer goods, and infrastructure are ensuring exponential growth of the specialty chemicals. Similarly, a wide range of chemicals are used in the production of flavors and foods, adhesives, agrochemicals, lubricants, cosmetics, textile, construction, and other material are ensuring massive revenue for specialty chemical industry.

As per industry experts, construction chemicals, specialty polymers, electronic chemicals, and surfactants were the largest chemical segment as of 2017. Collectively, these chemical segments accounted for the majority of the global market share. About half of the global specialty chemical is consumed by four major industries: food & beverages, construction, electrical & electronics, and soap, cleaning & cosmetics. Additionally, automotive, oil & gas and mining, and pulp & paper are other prominent industries in the global market.

Favorable policies and growing government support in China and India are likely to boost the growth of the construction industry in these economies. Commercial as well as residential construction projects in India witnessed growth of nearly 7.1% in 2018. Similarly, India has a huge agriculture base, which is a vital part of the growth. On the other hand, China is known for its industrial manufacturing linked with the largest automotive production. Taking into account, these two countries are the key revenue-centric markets for specialty chemicals. Therefore, the demand for paints and coatings is likely to grow significantly in abovementioned industries due to a surge in automotive and construction projects. Furthermore, personal care industry is dominated by North American and Europe countries such as the U.S., Germany, Belgium, and others.

Taking into account the overall scenario, specialty chemicals have a diverse application range. However, construction chemicals, specialty polymers, electronic chemicals, and surfactants are the three major application areas in the market. Additionally, technological advancements in specialty chemicals, large end-use industry base, high demand from Europe and Asia Pacific, and growing demand for customized products from the automotive industry are driving the growth of the market significantly.

Leave a Comment