- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

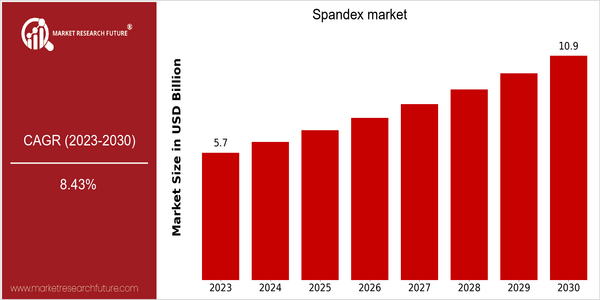

| Year | Value |

|---|---|

| 2023 | USD 5.69 Billion |

| 2030 | USD 10.87 Billion |

| CAGR (2023-2030) | 8.43 % |

Note – Market size depicts the revenue generated over the financial year

The market for spandex is expected to reach $ 5.69 billion in 2023, and is forecast to reach $ 10.87 billion by 2030, at a CAGR of 8.43%. This growth reflects the demand for spandex in many applications, especially in the clothing and textile industries, where its elasticity and comfort are highly valued. The increasing popularity of sportswear and athleisure wear, driven by the growing concern for health and well-being, is a major contributor to this upward trend. Also, the advances in textile technology, such as moisture wicking and breathability, are a factor in the growth of the spandex market. Also, the growing interest in sustainable fashion is encouraging manufacturers to develop eco-friendly spandex alternatives, which is expected to boost the market even further. Invista, Hyosung and Lenzing AG, for example, are investing in strategic alliances, and in research and development, in order to enhance their product portfolios and meet the needs of the consumers. These efforts will consolidate their positions in the market, and are expected to spur further growth in the spandex market.

Regional Market Size

Regional Deep Dive

The spandex market is characterized by its dynamic growth in various regions, which is driven by the growing demand for spandex in the apparel and textile industries. In North America, the market is influenced by the strong trend towards fitness and athleisure, while in Europe the trend is towards innovation and the search for sustainable development. The Asia-Pacific region is characterized by rapid industrialization and urbanization, which has led to a greater demand for versatile materials. In the Middle East and Africa, the market is driven by increasing income and changing fashion trends, while Latin America is slowly adopting spandex in various applications, especially in sportswear.

Europe

- European brands are increasingly adopting circular economy principles, with companies like Adidas launching initiatives to recycle spandex and reduce waste, reflecting a shift towards sustainable practices.

- Regulatory changes in the EU regarding textile waste management are pushing manufacturers to innovate in spandex production, leading to the development of biodegradable and recyclable spandex materials.

Asia Pacific

- The rapid urbanization in countries like China and India is driving the demand for spandex in both casual and performance wear, with local manufacturers such as Huafon Group expanding their production capabilities.

- Technological advancements in textile manufacturing, particularly in Japan and South Korea, are leading to the development of high-performance spandex fabrics that cater to specialized markets, such as sports and medical applications.

Latin America

- The increasing interest in sports and fitness activities in Latin America is driving the demand for spandex in sportswear, with local brands like Osklen and Hering expanding their product lines.

- Trade agreements within the region are facilitating easier access to spandex materials, which is expected to boost local manufacturing and reduce costs for consumers.

North America

- The rise of athleisure has significantly boosted the demand for spandex, with companies like Lululemon and Nike leading the charge in innovative fabric technologies that enhance comfort and performance.

- Sustainability initiatives are gaining traction, with brands such as Patagonia and Reformation focusing on eco-friendly spandex alternatives, which are reshaping consumer expectations and driving market growth.

Middle East And Africa

- The growing popularity of fitness and wellness culture in the Middle East is increasing the demand for spandex in activewear, with brands like Under Armour entering the market to capitalize on this trend.

- Government initiatives aimed at promoting local textile industries in countries like Egypt are encouraging investments in spandex production, which is expected to enhance regional supply chains.

Did You Know?

“Spandex can stretch up to five times its original length, making it one of the most versatile materials in the textile industry.” — Textile World

Segmental Market Size

Spandex is a growing business, especially in clothing. The increasing demand for comfort and ease of movement in clothing is reflected in the growing popularity of stretch materials. The rise of athleisure and the growing popularity of activewear have also contributed to this demand. And developments in textile technology are improving the performance of spandex, which makes it more attractive to manufacturers and consumers. The use of spandex is at a mature stage now. Leading brands like Lululemon and Nike have made extensive use of the material in their collections. The main applications are sportswear, swimwear and underwear, where the elasticity of spandex is essential for comfort and fit. And the growing interest in sustainable development is also affecting the market. Brands are looking for sustainable alternatives to conventional spandex. Also, the development of 3D knitting and digital printing is influencing the market. They are enabling new designs and less waste in production.

Future Outlook

The spandex market is set to grow significantly between 2023 and 2030, with the market value expected to nearly double from $5.69 billion to $11.87 billion, at a CAGR of 8.43%. The demand for spandex is growing as the consumers are seeking high-performance fabrics in the active-wear, athleisure, and intimate apparel. The main reason for the high demand is the growing consumer demand for comfortable and stretchable clothes. Health and fitness are two major trends gaining momentum all over the world, and as a result, the use of spandex in active-wear is expected to rise, with its share in the active-wear segment potentially reaching over 30% by 2030, according to industry projections. In addition, the development of eco-friendly spandex alternatives and the innovations in the fibers are likely to drive the market growth. The increasing focus on the environment in the textile industry is pushing the manufacturers to develop biodegradable and recycled spandex alternatives, which is in line with the growing demand for eco-friendly products among the consumers. The government initiatives promoting the sustainable practices in the textile industry are also likely to push the uptake of these innovations. Also, the emergence of smart textiles and the individualized fashion are likely to open up new opportunities for spandex.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 8.43% (2023-2030) |

Spandex Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.