Rising Cybersecurity Concerns

The Spain Virtual Desktop Market is increasingly shaped by rising cybersecurity concerns among organizations. With the growing frequency of cyber threats, businesses are prioritizing the protection of sensitive data and ensuring compliance with regulations such as the General Data Protection Regulation (GDPR). Virtual desktops offer enhanced security features, including centralized management and data encryption, which are appealing to organizations looking to mitigate risks. A survey conducted in 2025 revealed that 65% of Spanish companies consider cybersecurity a top priority, leading to a heightened interest in virtual desktop solutions that provide robust security measures. This trend is expected to drive further growth in the virtual desktop market as organizations seek to safeguard their digital assets.

Supportive Regulatory Environment

The Spain Virtual Desktop Market benefits from a supportive regulatory environment that encourages the adoption of digital technologies. The Spanish government has implemented various policies aimed at fostering innovation and digitalization, including tax incentives for companies investing in technology. These initiatives are likely to stimulate the growth of the virtual desktop market as organizations seek to leverage these benefits. Additionally, the European Union's Digital Single Market strategy aims to create a seamless digital environment across member states, which may further enhance the attractiveness of virtual desktop solutions in Spain. As businesses navigate this regulatory landscape, the potential for growth in the virtual desktop market appears promising.

Integration of Advanced Technologies

The Spain Virtual Desktop Market is witnessing a trend towards the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into virtual desktop solutions. These technologies enhance user experience by providing personalized services and optimizing resource allocation. As organizations in Spain increasingly recognize the potential of AI and ML, the demand for virtual desktops that incorporate these technologies is likely to rise. For instance, companies are exploring AI-driven analytics to improve performance and streamline operations. This integration not only enhances productivity but also positions virtual desktop solutions as a strategic asset in the digital landscape, potentially attracting more investments in the sector.

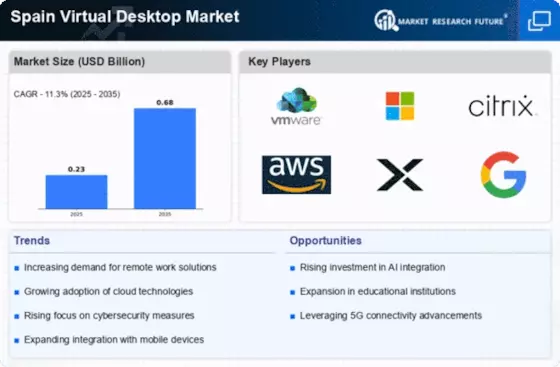

Growing Demand for Remote Work Solutions

The Spain Virtual Desktop Market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for virtual desktops has become paramount. According to recent data, approximately 30% of Spanish companies have implemented remote work policies, driving the adoption of virtual desktop infrastructure (VDI) to facilitate secure and efficient access to corporate resources. This trend is likely to continue, as businesses recognize the benefits of enhanced productivity and employee satisfaction associated with remote work. Furthermore, the Spanish government has been supportive of digital transformation initiatives, which may further bolster the growth of the virtual desktop market in the region.

Investment in Digital Transformation Initiatives

The Spain Virtual Desktop Market is significantly influenced by the ongoing investment in digital transformation initiatives across various sectors. The Spanish government has allocated substantial funding to promote technological advancements, with a focus on enhancing digital infrastructure. Reports indicate that the public sector alone is expected to invest over 1 billion euros in digitalization efforts by 2026. This investment is likely to create a conducive environment for the adoption of virtual desktop solutions, as organizations seek to modernize their IT infrastructure. Additionally, private enterprises are also channeling resources into digital transformation, further propelling the demand for virtual desktops as a means to streamline operations and improve service delivery.