Government Initiatives and Funding

Government initiatives in Spain are playing a crucial role in the expansion of the medical robotics market. The Spanish government has recognized the potential of robotics in healthcare and is actively funding research and development projects. In 2025, public funding for medical technology is expected to reach €200 million, aimed at fostering innovation in robotic systems. These initiatives not only support the development of new technologies but also encourage collaboration between public institutions and private companies. As a result, the medical robotics market is likely to benefit from enhanced research capabilities and the introduction of cutting-edge solutions that improve patient care.

Technological Advancements in Robotics

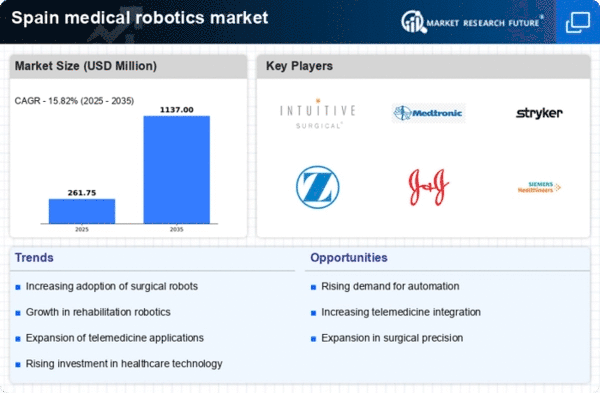

The medical robotics market in Spain is experiencing a surge due to rapid technological advancements. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of robotic systems. These advancements allow for more precise surgical procedures, reducing recovery times and improving patient outcomes. In 2025, the market is projected to grow at a CAGR of approximately 15%, driven by the increasing adoption of robotic-assisted surgeries. Hospitals are investing in state-of-the-art robotic systems, which are becoming essential tools in various medical fields, including orthopedics and urology. This trend indicates a shift towards more automated and efficient healthcare solutions, positioning Spain as a leader in the medical robotics market.

Aging Population and Increased Healthcare Demand

Spain's aging population is a significant driver of the medical robotics market. As the demographic shifts towards an older population, the demand for advanced healthcare solutions rises. Older adults often require surgical interventions, which can benefit from robotic assistance. the medical robotics market is projected to see a substantial increase in demand, with projections suggesting a growth rate of around 12% annually. This demographic trend necessitates the development of more efficient surgical techniques and rehabilitation processes, which robotic systems can provide. Consequently, healthcare providers are increasingly integrating robotics into their services to meet the needs of this growing patient population.

Rising Awareness and Acceptance of Robotic Surgery

There is a growing awareness and acceptance of robotic surgery among both healthcare professionals and patients in Spain. As more successful robotic surgeries are performed, the medical robotics market is witnessing increased trust and demand. Educational campaigns and training programs for surgeons are contributing to this trend, with a reported increase in robotic surgery procedures by 20% in the last year. Patients are becoming more informed about the benefits of robotic-assisted surgeries, such as reduced pain and shorter hospital stays. This shift in perception is likely to drive further adoption of robotic technologies in surgical practices across the country.

Collaboration Between Medical Institutions and Tech Companies

Collaboration between medical institutions and technology companies is emerging as a vital driver for the medical robotics market in Spain. Partnerships are fostering innovation and accelerating the development of advanced robotic systems tailored to specific medical needs. In 2025, it is anticipated that collaborative projects will account for over 30% of new robotic technologies introduced in the market. These collaborations enable the sharing of expertise and resources, leading to the creation of more effective and user-friendly robotic solutions. As a result, the medical robotics market is likely to expand, offering enhanced surgical options and improving overall healthcare delivery.