Regulatory Support

The direct carrier-billing market in Spain benefits from a favorable regulatory environment that encourages innovation and competition. The Spanish government has implemented policies aimed at promoting digital payments and enhancing consumer protection. For instance, the introduction of the European Union's PSD2 directive has paved the way for more secure and efficient payment methods, including carrier billing. This regulatory support is crucial for the industry, as it fosters trust among consumers and encourages them to adopt direct carrier-billing solutions. Additionally, the government's focus on digital transformation aligns with the industry's growth objectives, potentially leading to increased investment and development in the sector. As regulations evolve, they may further enhance the operational landscape for the direct carrier-billing market, making it more attractive for both consumers and service providers.

Technological Advancements

Technological advancements play a pivotal role in shaping the direct carrier-billing market in Spain. Innovations in mobile payment technologies, such as Near Field Communication (NFC) and enhanced encryption methods, are making carrier billing more secure and user-friendly. As of November 2025, the integration of artificial intelligence and machine learning in payment processing is also gaining traction, allowing for better fraud detection and improved customer experiences. These advancements not only enhance the security of transactions but also streamline the payment process, making it more appealing to consumers. The direct carrier-billing market stands to benefit from these technological developments, as they may lead to increased adoption rates and a broader acceptance of carrier billing as a mainstream payment method. This evolution suggests a dynamic future for the industry, driven by continuous innovation.

Increased Mobile Penetration

The direct carrier-billing market in Spain is experiencing growth due to the increasing penetration of mobile devices. As of November 2025, mobile subscriptions in Spain have reached approximately 120 million, indicating a penetration rate of around 250% of the population. This high level of mobile device usage facilitates seamless transactions, allowing consumers to make purchases directly through their mobile carriers. The convenience of carrier billing appeals to users who prefer not to use credit cards or other payment methods. Furthermore, the rise of mobile applications and digital content consumption has created a fertile ground for the direct carrier-billing market, as users seek easy and quick payment solutions for apps, games, and digital services. This trend suggests a promising future for the industry as more consumers engage with mobile technology.

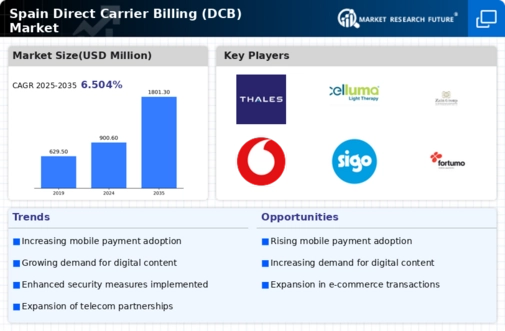

Growing Demand for Digital Content

The direct carrier-billing market in Spain is significantly influenced by the growing demand for digital content. As of November 2025, the digital content market in Spain is valued at approximately €3 billion, with mobile gaming and streaming services leading the charge. This surge in demand creates a substantial opportunity for the direct carrier-billing market, as consumers seek convenient payment methods for their digital purchases. Carrier billing offers a frictionless experience, allowing users to charge their purchases directly to their mobile accounts. This is particularly appealing to younger demographics who are more inclined to use mobile devices for entertainment and social engagement. The increasing popularity of subscription-based services further fuels this trend, suggesting that the direct carrier-billing market could see continued growth as more consumers opt for digital content consumption.

Consumer Preference for Convenience

Consumer preference for convenience is a significant driver of the direct carrier-billing market in Spain. As lifestyles become increasingly fast-paced, consumers are seeking payment solutions that offer simplicity and speed. Direct carrier billing allows users to make purchases without the need for credit cards or lengthy registration processes, appealing to those who prioritize efficiency. Surveys indicate that approximately 70% of Spanish consumers prefer payment methods that do not require entering sensitive financial information. This trend is particularly pronounced among younger consumers, who are more likely to engage with mobile apps and digital services. The direct carrier-billing market is well-positioned to capitalize on this consumer behavior, as it provides a straightforward and hassle-free payment option. As convenience continues to be a priority for consumers, the industry may experience sustained growth and increased market penetration.