Regulatory Support and Standards

The dental 3d-printing market in Spain is benefiting from supportive regulatory frameworks that promote innovation while ensuring patient safety. The Spanish government has implemented guidelines that facilitate the approval and use of 3D-printed dental products, which is crucial for market expansion. Compliance with these regulations not only enhances consumer trust but also encourages dental practitioners to adopt 3D printing technologies. As a result, the market is expected to grow by approximately 10% over the next few years, as more dental clinics integrate 3D printing into their practices. This regulatory support is essential for fostering a competitive environment, enabling local manufacturers to thrive and contribute to the advancement of the dental 3d-printing market.

Rising Awareness of Dental Health

The increasing awareness of dental health among the Spanish population is driving demand for advanced dental solutions, including those offered by the dental 3d-printing market. Educational campaigns and initiatives by health organizations have led to a greater understanding of the importance of oral hygiene and regular dental check-ups. This heightened awareness is reflected in a growing number of patients seeking preventive and corrective dental treatments, which in turn fuels the demand for 3D-printed dental products. As more individuals prioritize their dental health, the market is expected to expand by approximately 8% annually, highlighting the critical role that awareness plays in shaping the future of the dental 3d-printing market.

Growing Demand for Aesthetic Dentistry

The rising consumer awareness regarding aesthetic dentistry is significantly influencing the dental 3d-printing market. In Spain, there is an increasing preference for cosmetic dental procedures, such as veneers and crowns, which require precise and customized solutions. This trend is reflected in a market growth rate of around 12% annually, as patients seek personalized dental care that enhances their appearance. Dental professionals are increasingly turning to 3D printing to meet this demand, as it allows for the creation of tailored dental products that align with individual patient needs. The ability to produce intricate designs quickly and cost-effectively positions 3D printing as a vital tool in the aesthetic dentistry sector, thereby driving the overall growth of the dental 3d-printing market.

Technological Advancements in 3D Printing

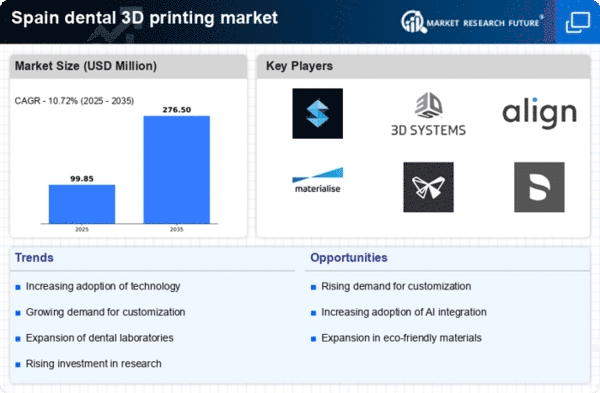

The dental 3d-printing market is experiencing rapid technological advancements that enhance the precision and efficiency of dental products. Innovations in materials, such as biocompatible resins and metals, are enabling the production of more durable and aesthetically pleasing dental prosthetics. In Spain, the adoption of advanced 3D printing technologies is projected to increase by approximately 15% annually, driven by the demand for high-quality dental solutions. Furthermore, the integration of artificial intelligence and machine learning in design processes is streamlining workflows, reducing production times, and minimizing errors. This evolution in technology not only improves patient outcomes but also positions Spain as a competitive player in the dental 3d-printing market, attracting investments and fostering research and development initiatives.

Increased Investment in Dental Technologies

Investment in dental technologies is a key driver of growth in the dental 3d-printing market. In Spain, both private and public sectors are recognizing the potential of 3D printing to revolutionize dental practices. Recent reports indicate that investments in dental technology have surged by 20% in the past year, with a significant portion allocated to 3D printing initiatives. This influx of capital is facilitating research, development, and the establishment of state-of-the-art facilities that enhance production capabilities. As dental clinics and laboratories adopt these technologies, they are likely to improve service delivery and patient satisfaction, further propelling the growth of the dental 3d-printing market.