Rising Construction Activities

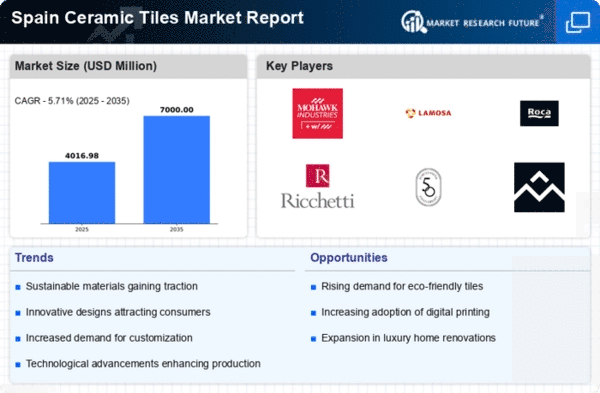

The ongoing expansion of the construction sector in Spain appears to be a primary driver for the ceramic tiles market. With a projected growth rate of approximately 4.5% annually, the demand for ceramic tiles is likely to increase as new residential and commercial projects emerge. The construction of new housing units, commercial spaces, and infrastructure developments necessitates durable and aesthetically pleasing materials, which ceramic tiles provide. Furthermore, the Spanish government's initiatives to promote urban development and renovation projects may further stimulate the market. As a result, the ceramic tiles market is expected to benefit significantly from these rising construction activities, leading to increased sales and market penetration.

Consumer Preference for Aesthetic Appeal

In Spain, there is a noticeable shift in consumer preferences towards aesthetically appealing and stylish flooring options. This trend is driving the ceramic tiles market, as consumers increasingly seek designs that enhance the visual appeal of their living spaces. The market is witnessing a surge in demand for decorative tiles, which are often used in kitchens and bathrooms. According to recent data, the decorative segment of the ceramic tiles market accounts for nearly 30% of total sales in Spain. This inclination towards aesthetics, combined with the versatility of ceramic tiles in various designs and finishes, suggests that the ceramic tiles market will continue to thrive as consumers prioritize style alongside functionality.

Sustainability and Eco-Friendly Products

The rising awareness of environmental issues among consumers in Spain is driving the demand for sustainable and eco-friendly products, including ceramic tiles. Many manufacturers are now focusing on producing tiles made from recycled materials and utilizing energy-efficient production methods. This shift towards sustainability is not only appealing to environmentally conscious consumers but also aligns with government regulations promoting eco-friendly construction practices. As a result, the ceramic tiles market is likely to experience growth as more consumers seek out sustainable options for their flooring needs, potentially leading to a larger market share for eco-friendly ceramic tiles.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of ceramic tiles are significantly influencing the market in Spain. Innovations such as digital printing and advanced glazing techniques allow manufacturers to produce high-quality tiles with intricate designs and textures. These technologies not only enhance the aesthetic appeal of ceramic tiles but also improve their durability and resistance to wear and tear. As a result, the ceramic tiles market is likely to see an increase in demand for high-performance tiles that meet the evolving needs of consumers. Furthermore, the integration of eco-friendly manufacturing practices may also attract environmentally conscious buyers, thereby expanding the market's reach.

Increased Renovation and Remodeling Activities

The trend of home renovation and remodeling in Spain is emerging as a significant driver for the ceramic tiles market. Many homeowners are opting to upgrade their living spaces, leading to a heightened demand for ceramic tiles that offer both functionality and style. Recent statistics indicate that approximately 60% of homeowners in Spain engage in renovation projects, with kitchens and bathrooms being the most common areas for tile installation. This growing inclination towards home improvement suggests that the ceramic tiles market will continue to benefit from increased sales as consumers invest in quality materials to enhance their homes.