Expansion of E-commerce Platforms

The rapid expansion of e-commerce platforms is transforming the nutricosmetics market landscape in South Korea. With the increasing penetration of the internet and mobile devices, consumers are turning to online shopping for convenience and variety. E-commerce sales of nutricosmetic products have surged, with estimates indicating a growth rate of 12% annually. This shift allows consumers to access a wider range of products and brands, often at competitive prices. Additionally, online platforms provide valuable consumer insights and feedback, enabling brands to tailor their offerings more effectively. As e-commerce continues to thrive, it is likely to play a crucial role in the growth of the nutricosmetics market.

Influence of Social Media and Beauty Trends

The impact of social media on beauty trends is a significant driver for the nutricosmetics market in South Korea. Platforms such as Instagram and TikTok have become vital in shaping consumer perceptions and preferences. Influencers and beauty enthusiasts frequently promote nutricosmetic products, showcasing their benefits and effectiveness. This has led to a notable increase in product visibility and consumer interest. Recent statistics indicate that approximately 60% of South Korean consumers are influenced by social media when making beauty-related purchases. As a result, brands are increasingly investing in social media marketing strategies to capture the attention of potential customers, thereby driving growth in the nutricosmetics market.

Increasing Consumer Awareness of Skin Health

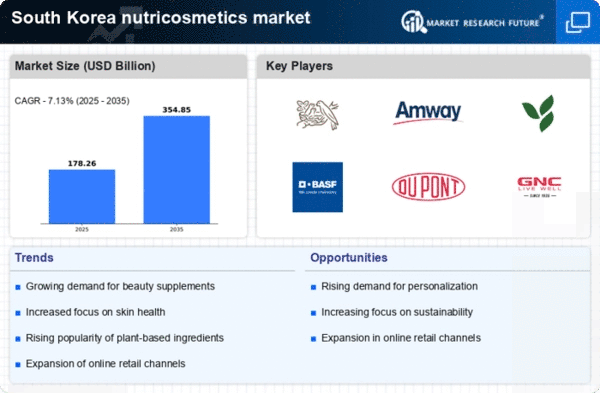

The growing awareness among consumers regarding skin health is a pivotal driver for the nutricosmetics market. In South Korea, individuals are increasingly informed about the benefits of nutrition for skin vitality. This trend is reflected in the rising sales of nutricosmetic products, which are perceived as effective solutions for skin issues. According to recent data, the market is projected to grow at a CAGR of 8.5% from 2025 to 2030. Consumers are now more inclined to seek products that not only enhance beauty but also promote overall skin health, leading to a surge in demand for nutricosmetics that combine beauty and wellness. This shift in consumer behavior is likely to propel the nutricosmetics market forward, as brands adapt to meet these evolving preferences.

Rising Interest in Preventive Health Solutions

The increasing focus on preventive health solutions is a notable driver for the nutricosmetics market. South Korean consumers are becoming more proactive about their health, seeking products that not only enhance beauty but also contribute to overall well-being. This trend is evident in the growing popularity of supplements that support skin health, hair vitality, and nail strength. Market Research Future suggests that the nutricosmetics market is expected to reach a valuation of $1.5 billion by 2027, driven by this preventive health approach. Consumers are likely to prioritize products that offer dual benefits, thus encouraging brands to innovate and expand their offerings in the nutricosmetics market.

Regulatory Support for Health and Beauty Products

Regulatory support for health and beauty products is an essential driver for the nutricosmetics market in South Korea. The government has implemented policies that encourage innovation and safety in the beauty and health sectors. This regulatory framework fosters consumer trust and confidence in nutricosmetic products, which is vital for market growth. Recent initiatives have streamlined the approval process for new ingredients and formulations, allowing brands to introduce innovative products more swiftly. As a result, the nutricosmetics market is likely to benefit from a more dynamic and competitive environment, with an increasing number of products entering the market to meet consumer demands.