Enhanced User Experience

User experience plays a crucial role in the growth of the direct carrier-billing market. In South Korea, consumers increasingly favor payment methods that offer simplicity and efficiency. Direct carrier-billing provides a streamlined process, allowing users to complete transactions with minimal steps. This ease of use is particularly appealing to younger demographics, who are accustomed to quick and hassle-free payment solutions. As mobile applications continue to evolve, developers are likely to integrate direct carrier-billing options to enhance user satisfaction. The direct carrier-billing market is thus positioned to benefit from this trend, as improved user experience can lead to higher transaction volumes and increased consumer loyalty.

Increased Smartphone Penetration

The proliferation of smartphones in South Korea has been a pivotal driver for the direct carrier-billing market. As of 2025, smartphone penetration in the country is estimated to exceed 95%, facilitating seamless access to mobile applications and services. This high penetration rate enables consumers to engage in digital transactions more readily, thereby boosting the adoption of direct carrier-billing solutions. The convenience of charging purchases directly to mobile accounts appeals to users, particularly for in-app purchases and digital content. Furthermore, the integration of advanced mobile technologies, such as 5G, enhances user experience, making mobile payments faster and more reliable. Consequently, the direct carrier-billing market is likely to experience substantial growth as more consumers leverage their smartphones for various transactions.

Growing Demand for Digital Content

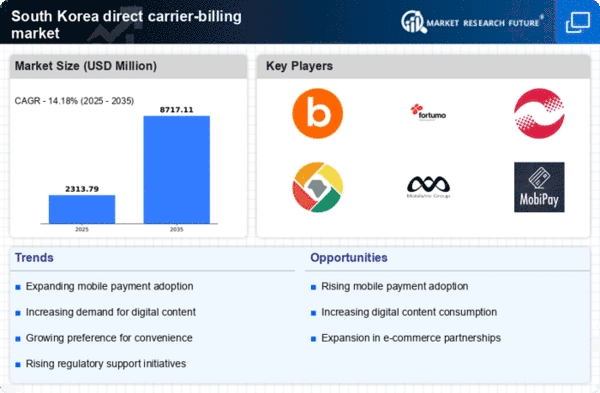

The increasing appetite for digital content in South Korea significantly propels the direct carrier-billing market. With a robust entertainment industry, including gaming, streaming services, and e-books, consumers are increasingly willing to pay for digital content. In 2025, the revenue generated from digital content is projected to reach approximately $5 billion, with a considerable portion attributed to direct carrier-billing. This payment method offers a frictionless experience, allowing users to purchase content without the need for credit cards or external payment systems. As more content providers adopt direct carrier-billing as a payment option, the market is expected to expand, catering to the preferences of tech-savvy consumers who prioritize convenience and speed in their transactions.

Strategic Partnerships with Content Providers

Strategic collaborations between mobile carriers and content providers are emerging as a significant driver for the direct carrier-billing market. In South Korea, mobile operators are increasingly partnering with gaming companies, streaming platforms, and app developers to facilitate direct billing options. These partnerships not only expand the range of services available to consumers but also enhance the visibility of direct carrier-billing as a payment method. By offering exclusive content or promotions through these collaborations, mobile carriers can attract more users to utilize direct carrier-billing. This trend is likely to foster a more competitive landscape, encouraging innovation and further growth within the direct carrier-billing market.

Regulatory Framework Supporting Digital Payments

The regulatory environment in South Korea is evolving to support the growth of digital payment solutions, including the direct carrier-billing market. Recent initiatives by the government aim to create a more conducive atmosphere for digital transactions, ensuring consumer protection and fostering innovation. Regulations that simplify the onboarding process for new payment providers and enhance security measures are likely to encourage more businesses to adopt direct carrier-billing. As the regulatory framework becomes more favorable, it is expected that the direct carrier-billing market will witness increased participation from various stakeholders, ultimately leading to a more robust and dynamic ecosystem.