Growing Awareness of Functional Foods

There is a marked increase in consumer awareness regarding functional foods in South Africa, which is positively impacting the prebiotics market. Functional foods, which provide health benefits beyond basic nutrition, are becoming a staple in many households. This trend is supported by educational campaigns and marketing efforts that emphasize the health advantages of prebiotics, such as improved gut health and enhanced immune function. Recent surveys indicate that approximately 60% of South African consumers are actively seeking functional food options, suggesting a strong market potential. As the prebiotics market continues to align with this growing interest, manufacturers are likely to innovate and expand their product lines to meet consumer demands.

Rising Popularity of Plant-Based Diets

The shift towards plant-based diets in South Africa is significantly influencing the prebiotics market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-derived prebiotics is expected to rise. These dietary choices are often associated with health benefits, including improved gut health and reduced risk of chronic diseases. Market analysis suggests that the plant-based food sector is anticipated to grow by over 10% annually, which could lead to a corresponding increase in the consumption of prebiotic-rich foods. This trend not only reflects changing dietary preferences but also highlights the potential for innovation in product offerings within the prebiotics market, catering to a more health-oriented consumer base.

Increased Investment in Health and Wellness

Investment in health and wellness sectors is on the rise in South Africa, which is likely to bolster the prebiotics market. With both private and public sectors recognizing the economic benefits of a healthier population, funding for health-related initiatives is increasing. This includes investments in research and development for prebiotic products, which could lead to enhanced formulations and new product launches. The South African government has also shown support for health initiatives, which may further stimulate market growth. As a result, the prebiotics market stands to gain from this influx of investment, potentially leading to innovative products that cater to the evolving needs of health-conscious consumers.

Increasing Demand for Digestive Health Products

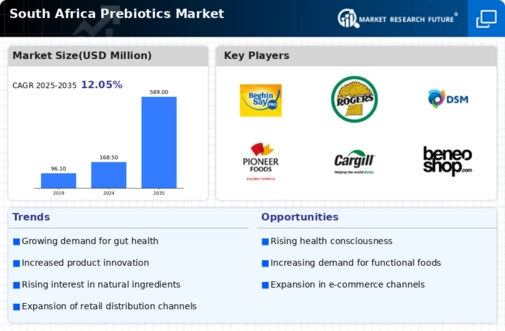

The prebiotics market in South Africa is experiencing a notable surge in demand for products that promote digestive health. This trend is largely driven by a growing awareness among consumers regarding the importance of gut health. As individuals become more health-conscious, they are increasingly seeking dietary supplements and functional foods that contain prebiotics. According to recent data, the digestive health segment is projected to grow at a CAGR of approximately 8% over the next five years. This indicates a robust market potential for prebiotic products, as consumers prioritize their well-being and seek solutions that enhance their digestive systems. The prebiotics market is thus positioned to benefit from this increasing consumer focus on health and wellness.

Emerging E-commerce Platforms for Health Products

The rise of e-commerce platforms in South Africa is transforming the way consumers access health products, including those in the prebiotics market. Online shopping offers convenience and a wider selection of products, making it easier for consumers to find and purchase prebiotic supplements and functional foods. Recent data indicates that online sales of health products have increased by over 30% in the past year, reflecting a shift in consumer purchasing behavior. This trend is likely to continue, as more consumers turn to digital platforms for their health needs. Consequently, the prebiotics market is expected to benefit from enhanced visibility and accessibility, allowing manufacturers to reach a broader audience.