Cultural Shifts and Dietary Trends

Cultural shifts in dietary preferences are significantly impacting the meat substitutes market in South Africa. The rise of vegetarianism and veganism, along with a growing interest in flexitarian diets, is reshaping consumer behavior. Many South Africans are increasingly adopting plant-based diets for ethical, health, or environmental reasons. This cultural transformation is reflected in the expanding variety of meat alternatives available in the market. The meat substitutes market is responding to these changing preferences by introducing innovative products that cater to diverse tastes and dietary needs. As more consumers embrace these dietary trends, the demand for meat substitutes is expected to grow, indicating a shift in the culinary landscape of South Africa.

Economic Factors and Affordability

Economic conditions play a crucial role in shaping the meat substitutes market in South Africa. As the cost of traditional meat products fluctuates, consumers are increasingly exploring alternative protein sources that may offer better value. The rising prices of meat due to supply chain disruptions and inflation have made meat substitutes more appealing. In 2025, the average price of beef is projected to reach approximately R150 per kg, prompting consumers to consider more affordable options. This economic pressure is likely to drive growth in the meat substitutes market, as consumers seek budget-friendly alternatives that do not compromise on taste or nutrition. The affordability of plant-based products could thus enhance their market penetration.

Retail and Distribution Innovations

Innovations in retail and distribution channels are playing a pivotal role in the growth of the meat substitutes market in South Africa. The rise of e-commerce and online grocery shopping has made it easier for consumers to access a wide range of meat alternatives. Additionally, supermarkets and health food stores are increasingly dedicating shelf space to plant-based products, enhancing their visibility and availability. This trend is supported by data showing that online sales of meat substitutes have increased by 30% in the past year. As retailers adapt to changing consumer preferences and invest in marketing strategies for meat alternatives, the meat substitutes market is likely to experience accelerated growth. The convenience and accessibility of these products are expected to further drive consumer adoption.

Health Consciousness Among Consumers

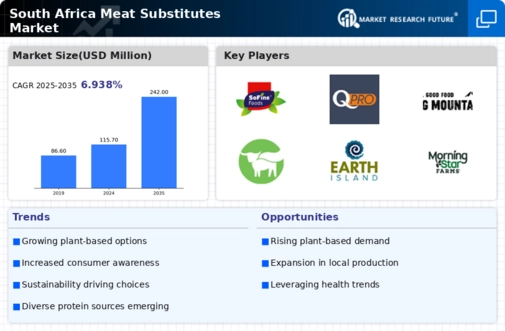

The increasing awareness of health issues related to meat consumption is driving the meat substitutes market in South Africa. Consumers are becoming more health-conscious, seeking alternatives that offer lower fat content and higher nutritional value. This shift is reflected in the growing demand for plant-based proteins, which are perceived as healthier options. According to recent data, the market for meat substitutes is projected to grow at a CAGR of 8.5% over the next five years. This trend indicates a significant shift in consumer preferences towards healthier diets, which is likely to continue influencing the meat substitutes market. As more individuals prioritize their health, the demand for meat alternatives that provide essential nutrients without the drawbacks of traditional meat is expected to rise, further propelling the industry forward.

Environmental Concerns and Sustainability

Environmental issues are increasingly influencing consumer choices in South Africa, leading to a surge in the meat substitutes market. Concerns about climate change, deforestation, and water usage associated with livestock farming are prompting consumers to seek more sustainable food options. The meat substitutes market offers a viable solution to reduce the environmental footprint of food production. Research indicates that plant-based diets can reduce greenhouse gas emissions by up to 50%. This growing awareness of environmental sustainability is likely to drive demand for meat alternatives, as consumers become more inclined to support products that align with their values. The meat substitutes market is thus positioned to benefit from this shift towards eco-friendly consumption patterns.