Market Trends

Key Emerging Trends in the Solid State Battery Market

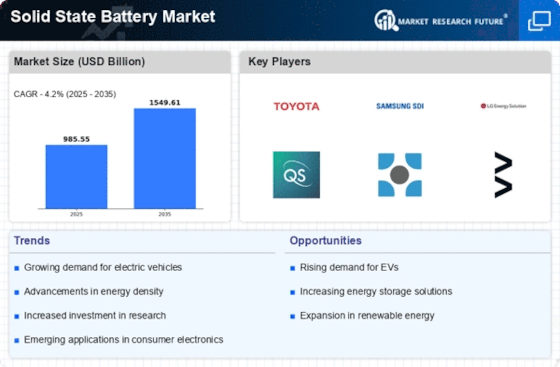

Tremendous changes are happening in the solid-state battery industry, with an accentuation on expanding energy thickness and execution. Expecting to expand the ease of use of these batteries for sustainable power stockpiling and electric vehicles, producers and specialists are putting resources into examination to build their capacity limit. This is in light of the developing interest for batteries with expanded life cycles and more prominent effectiveness. The car area is driving business sector patterns for solid state batteries in light of the rising fame of electric vehicles and the quest for options in contrast to lithium-particle batteries. Car organizations and makers of solid-state batteries are teaming up to integrate further developed batteries into electric vehicles of the future, with the objectives of expanding range, charging rate, and wellbeing. Because of the small size of solid-state batteries, scaling down in wearable and Web of Things gadgets is a creating pattern on the lookout. The goal of this pattern is to deliver electronic gadgets stronger, eco-accommodating, and powerful. Commercialization and versatility of strong state battery fabricating are advancing despite snags like significant expenses and adaptability. Commercialization for a bigger scope is made conceivable by speculations and improvements; firms are streamlining fabricating processes, getting unrefined substances, and achieving economies of scale. Strong electrolyte materials like sulphides, oxides, and polymers are acquiring market consideration as a way to upgrade the strength, security, and conductivity of solid-state batteries. Producers and scientists take part in continuous trial and error to recognize the most fitting materials for tending to the specialized difficulties that emerge in this area. The market for solid state batteries is going through a progress towards maintainability because of the chance of diminishing reliance on ordinary batteries and unsafe substances. Optional energy stockpiling choices are being pursued by shoppers, businesses, and policymakers, which is moving interests in earth great battery advancements. A pattern of vital organizations and joint efforts is arising in the solid-state battery market, pushed by the prerequisite for interdisciplinary mastery to address the difficulties of this innovation. Through the pooling of assets and the trading of data, these coalitions mean to speed up the turn of events and commercialization of solid-state batteries. Patterns like energy thickness improvement, auto impact, scaling down, commercialization, investigation of strong electrolyte materials, manageability, and associations all shape the strong state battery market. It is guessed that as progress continues, it will supply capacity to the impending age of maintainable energy stockpiling arrangements.

Leave a Comment