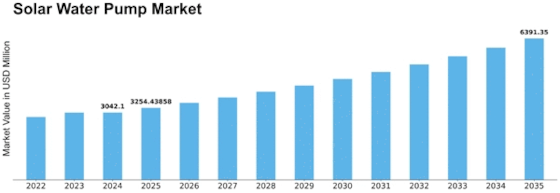

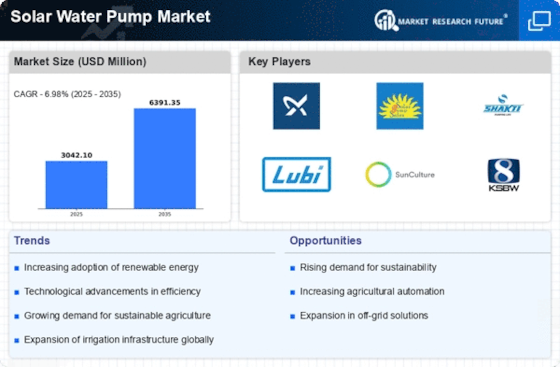

Solar Water Pumps Size

Solar Water Pumps Market Growth Projections and Opportunities

The solar water pumps market is influenced by various factors that contribute to its growth and development. One of the primary drivers of this market is the increasing focus on sustainable agriculture and water management practices. As traditional irrigation methods become increasingly unsustainable due to water scarcity and energy costs, farmers are turning to solar water pumps as an environmentally friendly and cost-effective alternative. Solar-powered pumps harness energy from the sun to pump water from wells, rivers, or other water sources, reducing reliance on fossil fuels and minimizing carbon emissions. This shift towards solar irrigation systems is driven by a growing awareness of the need to conserve water resources and mitigate the impacts of climate change on agricultural productivity.

Additionally, government incentives and policies play a significant role in driving the adoption of solar water pumps. Many governments around the world offer subsidies, grants, and tax incentives to promote the use of renewable energy technologies, including solar-powered irrigation systems. These incentives make solar water pumps more affordable and accessible to farmers, encouraging investment in sustainable water management solutions. Furthermore, government initiatives aimed at promoting rural electrification and improving access to clean water in remote areas often include provisions for the installation of solar-powered water pumps, further driving market growth.

Moreover, advancements in solar technology and improvements in pump efficiency are driving the expansion of the solar water pumps market. Innovations in photovoltaic (PV) panel design, battery storage systems, and pump technology have led to significant improvements in the performance and reliability of solar water pumps. Modern solar pumps are capable of operating in a wide range of conditions, including low-light and variable weather conditions, making them suitable for use in diverse agricultural environments. As the efficiency and reliability of solar water pumps continue to improve, they are increasingly being adopted as a dependable and sustainable solution for irrigation and water supply needs.

Furthermore, the rising demand for off-grid and decentralized water pumping solutions is fueling the growth of the solar water pumps market. In remote and rural areas where access to grid electricity is limited or unreliable, solar-powered pumps offer a reliable and independent source of energy for water pumping applications. These off-grid solar water pumping systems are particularly well-suited for smallholder farmers, livestock owners, and communities in remote locations who lack access to conventional electricity infrastructure. By providing reliable access to water for irrigation, livestock watering, and domestic use, solar water pumps can help improve livelihoods and enhance food security in underserved rural areas.

Additionally, the increasing adoption of solar water pumps in urban and industrial applications is contributing to market growth. Solar-powered pumps are being used for a wide range of applications beyond agriculture, including water supply for residential complexes, commercial buildings, and industrial facilities. In urban areas where electricity costs are high and grid reliability is a concern, solar water pumps offer a cost-effective and sustainable alternative for water pumping and distribution. Moreover, solar pumps are often used in combination with water treatment technologies to provide clean and safe drinking water in off-grid communities and disaster-affected areas, further expanding the market opportunities for solar water pump manufacturers and suppliers.

In conclusion, the solar water pumps market is driven by a combination of factors, including the growing demand for sustainable agriculture, government incentives and policies, technological advancements, the need for off-grid water pumping solutions, and the expansion of applications beyond agriculture. As awareness of the benefits of solar-powered irrigation systems continues to grow and technology advances, the solar water pumps market is expected to experience significant growth in the coming years. By leveraging these market factors and addressing the evolving needs of customers, companies operating in the solar water pumps market can capitalize on opportunities for innovation and expansion in a rapidly growing industry.

Leave a Comment