Top Industry Leaders in the Solar Powered Irrigation System Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Solar Powered Irrigation System industry are:

Lorentz (Germany)

Jain Irrigation Systems (India)

Netafim (Israel)

Grundfos (Denmark)

Solar Water Solutions (Kenya)

Bright Solar (China)

Shakti Pumps (India)

CRI Pumps (India)

Dankoff Solar Pumps (United States)

Rainbow Power Company (Australia)

Sunray Power (China)

Tata Power Solar Systems (India)

Bridging the Gap by Exploring the Competitive Landscape of the Solar Powered Irrigation System Top Players

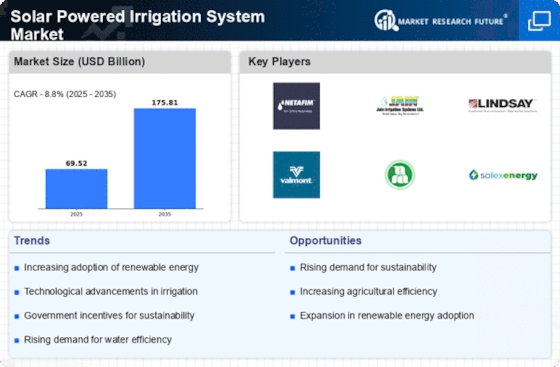

The solar-powered irrigation system market is experiencing a surge, fueled by growing concerns about water scarcity, rising energy costs, and environmental sustainability. This burgeoning sector presents a dynamic competitive landscape, with established players vying for dominance alongside emerging startups offering innovative solutions. Understanding the key strategies, market share factors, and emerging trends is crucial for navigating this competitive terrain.

Key Players and Strategies:

Established Players: Major agricultural equipment manufacturers like John Deere, Netafim, and Lindsay are leveraging their existing distribution networks and brand recognition to enter the solar irrigation space. They are focusing on developing robust, high-performance systems tailored for large-scale farming operations. John Deere's acquisition of Precision Planting in 2021 exemplifies this trend, strengthening their precision agriculture offerings with solar irrigation integration.

Technology Startups: Numerous startups are disrupting the market with innovative technologies and user-friendly solutions. These players, like SunRain and SunCulture, are focusing on smaller-scale farms, offering modular and scalable systems with advanced automation features. SunCulture's smart irrigation platform, utilizing soil sensors and weather data, optimizes water usage and reduces operational costs for farmers.

Regional Players: Local companies are emerging as strong contenders in specific regions. In India, companies like Jain Irrigation and Kirloskar Brothers are capitalizing on government subsidies and growing awareness of water conservation to offer affordable solar irrigation solutions.

Market Share Analysis:

Product Portfolio and Technology: The breadth and depth of a company's product portfolio, encompassing diverse system sizes, functionalities, and levels of automation, significantly impacts market share. Additionally, offering advanced features like remote monitoring and data analytics can attract tech-savvy farmers.

Geographical Reach and Distribution Network: Established players with extensive distribution networks in key agricultural regions have an advantage. However, startups can leverage partnerships with local distributors and online platforms to gain access to remote markets.

Pricing and Affordability: Striking a balance between offering competitive pricing and maintaining product quality is crucial. Startups often focus on cost-effective solutions, while established players may offer premium systems with higher price tags.

Government Policies and Subsidies: Government incentives and subsidies for adopting solar irrigation can significantly boost market share for companies catering to specific regions or farm sizes.

Emerging Trends:

Precision Irrigation and Data Analytics: Integrating soil sensors, weather data, and AI-powered algorithms into irrigation systems is enabling farmers to optimize water usage and improve crop yields. Companies like Rivulis and T-Systems are leading the way in this area.

Off-Grid Solutions and Storage Systems: Standalone solar irrigation systems with battery storage are gaining traction in areas with unreliable grid access. This allows farmers to irrigate even during power outages. SunCulture's portable solar irrigation kits exemplify this trend.

IoT and Cloud-Based Management: Connecting irrigation systems to the internet of things (IoT) platforms enables remote monitoring, data analysis, and automated control. This empowers farmers to manage their irrigation systems efficiently from anywhere.

Financing and Leasing Options: Offering flexible financing and leasing options can make solar irrigation more accessible to small and medium-sized farms. John Deere's partnership with John Deere Financial provides an example of this strategy.

Overall Competitive Scenario:

The solar-powered irrigation system market is characterized by intense competition, with established players, startups, and regional companies vying for market share. Differentiation through innovative technologies, customized solutions, and competitive pricing is key to success. Adapting to emerging trends like precision irrigation, off-grid solutions, and data-driven management will be crucial for companies to stay ahead of the curve. Additionally, collaborations and partnerships across the value chain can foster innovation and expand market reach. Understanding the evolving competitive landscape and key player strategies will be essential for stakeholders navigating this dynamic and promising market.

Latest Company Updates:

Lorentz (Germany):

• August 2023: Launched the new S series pumps, featuring higher efficiency and improved reliability for solar-powered irrigation. (Source: Lorentz website)

Jain Irrigation Systems (India):

• December 2023: Launched the "Jaisol" brand of solar-powered irrigation pumps, targeting small and medium-sized farmers. (Source: Jain Irrigation Systems website)

Netafim (Israel):

• November 2023: Announced a partnership with Grundfos to develop joint solutions for solar-powered irrigation in remote areas. (Source: Netafim press release)

Solar Water Solutions (Kenya):

• October 2023: Launched a new training program for farmers on the operation and maintenance of solar irrigation systems. (Source: Solar Water Solutions website)