Growing Environmental Regulations

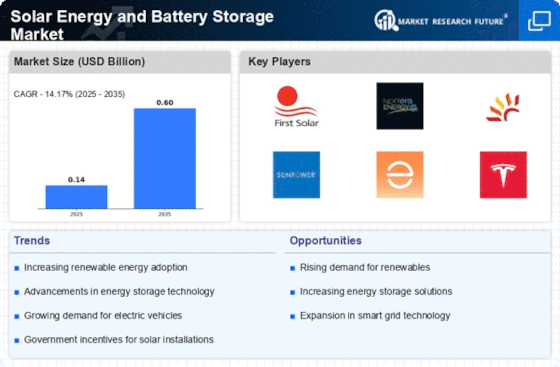

The Solar Energy and Battery Storage Market is increasingly influenced by stringent environmental regulations aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that mandate a transition to cleaner energy sources, thereby creating a favorable environment for solar energy adoption. For example, emissions reduction targets and renewable energy mandates are compelling utilities and businesses to invest in solar energy systems and battery storage solutions. This regulatory push not only fosters market growth but also encourages innovation in solar technologies. As environmental regulations become more rigorous, the demand for solar energy and battery storage is expected to rise, further solidifying their role in the energy landscape.

Rising Demand for Renewable Energy

The Solar Energy and Battery Storage Market is experiencing a notable surge in demand for renewable energy sources. This trend is largely driven by increasing awareness of climate change and the need for sustainable energy solutions. According to recent data, renewable energy accounted for approximately 29% of total electricity generation, with solar energy being a significant contributor. As consumers and businesses alike seek to reduce their carbon footprints, the adoption of solar energy systems and battery storage solutions is likely to accelerate. This shift not only aligns with environmental goals but also offers potential cost savings on energy bills, further incentivizing investment in solar technologies.

Government Incentives and Subsidies

The Solar Energy and Battery Storage Market benefits significantly from various government incentives and subsidies aimed at promoting renewable energy adoption. Many governments have implemented tax credits, rebates, and grants to encourage the installation of solar energy systems and battery storage solutions. For instance, certain regions offer up to 30% tax credits for solar installations, which can substantially lower the upfront costs for consumers. These financial incentives not only stimulate market growth but also enhance the overall attractiveness of solar energy as a viable alternative to traditional energy sources. As these programs evolve, they are likely to further bolster the market.

Declining Costs of Solar Technologies

The Solar Energy and Battery Storage Market is witnessing a dramatic decline in the costs associated with solar technologies. Over the past decade, the price of solar photovoltaic (PV) systems has decreased by nearly 90%, making solar energy more accessible to a broader audience. This reduction in costs is attributed to advancements in manufacturing processes and economies of scale. As prices continue to fall, more consumers and businesses are likely to invest in solar energy systems, thereby driving growth in the market. Additionally, the decreasing costs of battery storage solutions complement this trend, as they enhance the viability of solar energy by providing reliable energy storage options.

Technological Innovations in Energy Storage

The Solar Energy and Battery Storage Market is being propelled by ongoing technological innovations in energy storage solutions. Advances in battery technologies, such as lithium-ion and solid-state batteries, are enhancing the efficiency and capacity of energy storage systems. These innovations allow for better integration of solar energy into the grid, addressing intermittency issues associated with solar power generation. As energy storage becomes more efficient and cost-effective, it is expected to play a crucial role in the widespread adoption of solar energy systems. This synergy between solar energy and advanced storage technologies is likely to redefine energy consumption patterns in the coming years.