Top Industry Leaders in the Soil Monitoring Market

Competitive Landscape of the Soil Monitoring Market:

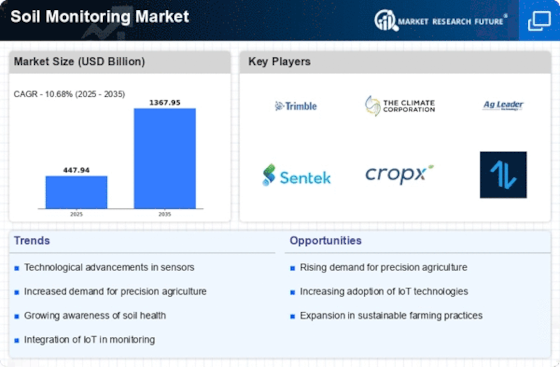

The soil monitoring market is burgeoning, fueled by a confluence of factors: rising concerns about soil health, the quest for improved agricultural productivity, and the burgeoning adoption of precision agriculture. This fertile ground fosters a dynamic competitive landscape, where established players jostle with new entrants, each vying for a larger slice of the pie.

Key Players:

- Stevens Water Monitoring Systems (US)

- SGS Group (Switzerland)

- METER Group (US)

- Element Material Technology (UK)

- The Toro Company (US)

- Campbell Scientific (US)

- Sontok Technologies (Australia)

- Spectrum Technologies (US)

- Irromotor (US)

- Cropx Technologies (Israel)

Strategies Driving Market Share:

- Product Differentiation: Companies are differentiating themselves by focusing on specific market segments or offering unique functionalities. METER Group, for instance, caters to research institutions and environmental monitoring projects, while Trimble targets large-scale agricultural operations. Arable Labs focuses on soil carbon sequestration and regenerative agriculture.

- Technological Advancements: Continuous innovation is key to staying ahead. Players are heavily invested in R&D, developing sensors with enhanced capabilities, data analytics platforms with advanced algorithms, and user-friendly interfaces. The integration of AI and machine learning is shaping the future of soil monitoring, enabling automated analysis and predictive insights.

- Partnerships and Collaborations: Strategic partnerships are fostering innovation and market reach. Collaborations with universities and research institutions drive technological advancements, while partnerships with agricultural equipment manufacturers and data service providers expand market access.

Factors Influencing Market Share Analysis:

- Geographic Distribution: The market varies across regions. Developed economies like the US and Europe are mature markets, while Asia-Pacific and Latin America offer significant growth potential due to rising agricultural production and government initiatives.

- Application Segments: Agriculture dominates the market, but environmental monitoring and land management are gaining traction. Players must cater to diverse needs within these segments to maximize reach.

- Pricing Strategies: Cost remains a crucial factor, especially for smaller farms. Companies are offering flexible pricing models, subscription services, and rental options to make soil monitoring solutions more accessible.

New and Emerging Companies:

- PrecisionHawk (USA): Utilizes drones and AI for soil analysis, crop health assessment, and yield prediction.

- Plantix (Germany): Offers a mobile app that uses smartphone images to diagnose plant diseases and recommend soil management practices.

- Netafim (Israel): Provides drip irrigation systems integrated with soil sensors for optimal water and fertilizer management.

Current Investment Trends:

- Focus on Data Analytics: Players are investing in data analytics platforms to convert raw sensor data into actionable insights for farmers.

- Integration with Existing Technologies: Companies are working on seamless integration of soil monitoring systems with farm management software and agricultural equipment.

- Sustainability Initiatives: Investments are directed towards developing solutions that promote soil health, carbon sequestration, and sustainable agriculture practices.

Latest Company Updates:

October 26, 2023, Precision agriculture startup, Terramera, raises USD 50 million in Series C funding to expand its soil health monitoring and analysis platform.

December 12, 2023, The European Commission announces a new initiative to invest EUR 1 billion in soil health research and development over the next five years.

January 9, 2024, A team of researchers at MIT develops a new soil sensor that can detect the presence of harmful bacteria and pathogens in real-time.