Rising Cybersecurity Threats

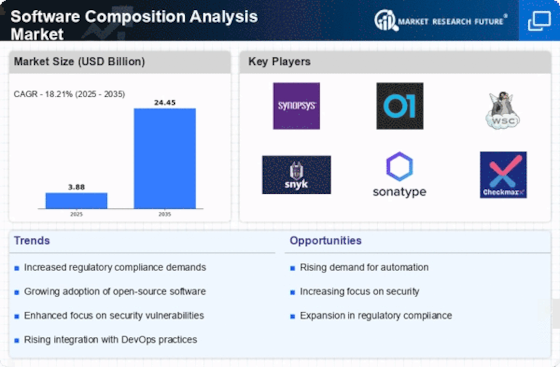

The Software Composition Analysis Market is experiencing heightened demand due to the increasing frequency and sophistication of cybersecurity threats. Organizations are increasingly aware of the vulnerabilities associated with open-source components and third-party libraries. As cyberattacks become more prevalent, the need for robust security measures has intensified. In 2025, it is estimated that the global cost of cybercrime could reach trillions of dollars, prompting businesses to invest in Software Composition Analysis tools to identify and mitigate risks. This trend indicates a growing recognition of the importance of securing software supply chains, thereby driving the Software Composition Analysis Market.

Integration of DevOps Practices

The Software Composition Analysis Market is being propelled by the integration of DevOps practices within software development processes. As organizations adopt DevOps methodologies, the need for continuous integration and continuous deployment (CI/CD) becomes paramount. This shift necessitates the use of Software Composition Analysis tools to ensure that security is embedded throughout the development lifecycle. By automating the identification of vulnerabilities in software components, organizations can enhance their security posture while maintaining agility. The increasing adoption of DevOps is likely to drive the Software Composition Analysis Market as companies seek to streamline their development processes without compromising security.

Regulatory Compliance Requirements

The Software Composition Analysis Market is significantly influenced by the evolving landscape of regulatory compliance. Governments and regulatory bodies are imposing stringent requirements on software development practices, particularly concerning data protection and privacy. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) necessitate that organizations ensure their software components are secure and compliant. As a result, companies are increasingly adopting Software Composition Analysis tools to ensure adherence to these regulations. The market is projected to grow as organizations prioritize compliance to avoid hefty fines and reputational damage.

Demand for Enhanced Software Quality

The Software Composition Analysis Market is significantly driven by the growing demand for enhanced software quality. As software applications become more complex, organizations are recognizing the importance of ensuring that all components are secure and reliable. Software Composition Analysis tools provide insights into the quality of open source and third-party components, enabling organizations to make informed decisions about their software supply chains. In 2025, the emphasis on software quality is expected to intensify, leading to increased investments in Software Composition Analysis solutions. This trend reflects a broader commitment to delivering high-quality software products that meet customer expectations.

Growing Adoption of Open Source Software

The Software Composition Analysis Market is witnessing a surge in the adoption of open source software across various sectors. Organizations are increasingly leveraging open source components for their flexibility and cost-effectiveness. However, this trend also introduces potential security vulnerabilities, as many open source libraries may contain unpatched flaws. Consequently, the demand for Software Composition Analysis tools is rising, as businesses seek to identify and remediate these vulnerabilities. In 2025, it is anticipated that the open source software market will continue to expand, further propelling the Software Composition Analysis Market as organizations strive to balance innovation with security.