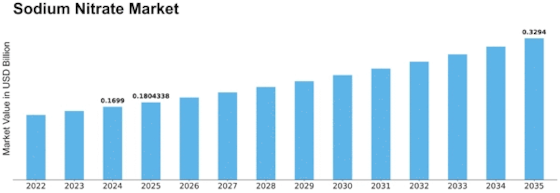

Sodium Nitrate Size

Sodium Nitrate Market Growth Projections and Opportunities

The Sodium Nitrate market is influenced by a variety of factors that impact its dynamics and growth. One significant factor is the widespread use of sodium nitrate across multiple industries. Sodium nitrate serves as a vital ingredient in the manufacturing of fertilizers, explosives, glass, ceramics, and food preservatives. Its versatility and wide range of applications make it a crucial commodity in industries such as agriculture, mining, chemical manufacturing, and food processing. The demand for sodium nitrate is thus directly linked to the performance and growth of these industries.

Additionally, agricultural practices and the global demand for food play a significant role in driving the sodium nitrate market. Sodium nitrate is extensively used as a nitrogen fertilizer to enhance crop yield and quality. With the world's population steadily increasing and arable land becoming scarcer, there is a growing need for fertilizers to boost agricultural productivity. As a result, the demand for sodium nitrate in the agricultural sector continues to rise, particularly in regions with intensive farming practices.

Moreover, regulatory factors influence the sodium nitrate market. Governments impose regulations and standards on the production, distribution, and use of sodium nitrate to ensure safety, environmental protection, and product quality. Compliance with these regulations is essential for manufacturers and distributors to maintain market access and consumer trust. Additionally, changes in regulatory frameworks related to chemical safety, environmental protection, and food additives can impact the demand and market dynamics of sodium nitrate.

Technological advancements also shape the sodium nitrate market. Continuous innovation in production processes, purification techniques, and product formulations improves the efficiency, quality, and cost-effectiveness of sodium nitrate manufacturing. Advanced technologies enable manufacturers to enhance product purity, reduce energy consumption, and minimize environmental impact, driving market growth and competitiveness.

Market competition is another significant factor influencing the sodium nitrate market. The market is characterized by numerous manufacturers and suppliers competing for market share by offering a wide range of sodium nitrate products tailored to different industries and applications. Competitive pricing strategies, product differentiation, and marketing initiatives drive market competition and influence consumer purchasing decisions.

Economic factors play a crucial role in shaping the sodium nitrate market. Economic conditions such as GDP growth, industrial output, and consumer spending influence demand for sodium nitrate products across various industries. During periods of economic expansion, increased industrial production, construction activity, and agricultural investment drive demand for sodium nitrate, while economic downturns may lead to temporary slowdowns in market growth as industries reduce production and investment.

Furthermore, the availability and cost of raw materials impact the production and pricing of sodium nitrate. Sodium nitrate is primarily derived from natural deposits or synthesized through chemical processes using raw materials such as sodium chloride and nitric acid. Fluctuations in the prices of these raw materials, supply chain disruptions, and geopolitical factors can affect production costs and profit margins for sodium nitrate manufacturers, influencing market dynamics.

Global market trends and geopolitical factors also influence the sodium nitrate market. Factors such as trade policies, tariffs, currency exchange rates, and geopolitical tensions can impact market dynamics, trade flows, and supply chain logistics, affecting the availability and pricing of sodium nitrate products in different regions. Additionally, changing consumer preferences, technological advancements, and industry consolidation shape the competitive landscape and market opportunities in the sodium nitrate market.

Leave a Comment