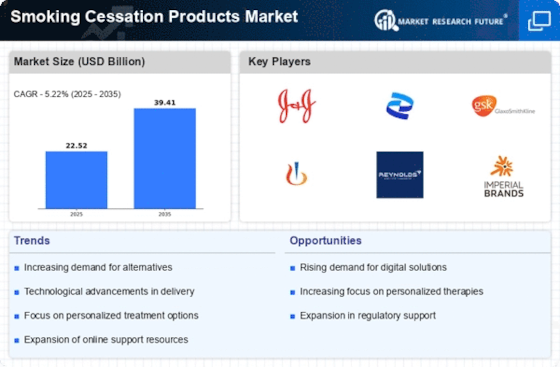

Rising Health Awareness

The increasing awareness regarding the adverse health effects of smoking appears to be a primary driver for the Smoking Cessation Products Market. As more individuals recognize the risks associated with tobacco use, including respiratory diseases and cardiovascular issues, there is a growing demand for cessation products. Reports indicate that approximately 70% of smokers express a desire to quit, which suggests a substantial market potential. This heightened health consciousness is further fueled by educational campaigns and public health initiatives aimed at reducing smoking prevalence. Consequently, manufacturers of smoking cessation products are likely to benefit from this trend, as consumers actively seek effective solutions to aid in their quitting journey.

Diverse Product Offerings

The Smoking Cessation Products Market is characterized by a diverse range of product offerings, which caters to varying consumer preferences and needs. From nicotine replacement therapies such as patches and gums to prescription medications and behavioral therapies, the variety allows individuals to choose the method that best suits their quitting journey. This diversity is crucial, as different smokers may respond better to different types of cessation aids. Market data suggests that the nicotine replacement therapy segment holds a significant share, accounting for over 40% of the market. The continuous introduction of new products and formulations is likely to further stimulate market growth.

Technological Advancements

Technological advancements in the development of smoking cessation products are reshaping the Smoking Cessation Products Market. Innovations such as mobile applications, digital platforms, and smart devices that track smoking habits and provide personalized support are gaining traction. These technologies enhance user engagement and improve the likelihood of successful cessation. For example, studies indicate that users of mobile cessation apps are 50% more likely to quit smoking compared to those who do not use such tools. As technology continues to evolve, it is expected that the market will see an influx of new products that leverage these advancements, catering to a tech-savvy consumer base.

Regulatory Support and Policies

Government regulations and policies aimed at reducing smoking rates significantly influence the Smoking Cessation Products Market. Many countries have implemented stringent laws regarding tobacco advertising, packaging, and sales, which indirectly promote the use of cessation products. For instance, the introduction of higher taxes on tobacco products has been shown to decrease smoking rates, thereby increasing the demand for cessation aids. Additionally, various governments provide funding for smoking cessation programs, which often include subsidized access to cessation products. This regulatory environment not only encourages smokers to seek help but also creates a favorable market landscape for manufacturers of smoking cessation products.

Increased Focus on Mental Health

The growing recognition of the link between mental health and smoking cessation is emerging as a vital driver for the Smoking Cessation Products Market. Many smokers use tobacco as a coping mechanism for stress and anxiety, which complicates their quitting efforts. As mental health awareness rises, there is a corresponding demand for cessation products that address these psychological aspects. Programs that integrate mental health support with cessation strategies are becoming more prevalent, indicating a shift in how cessation is approached. This trend suggests that products designed to support mental well-being during the quitting process may see increased adoption, thereby expanding the market.