- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

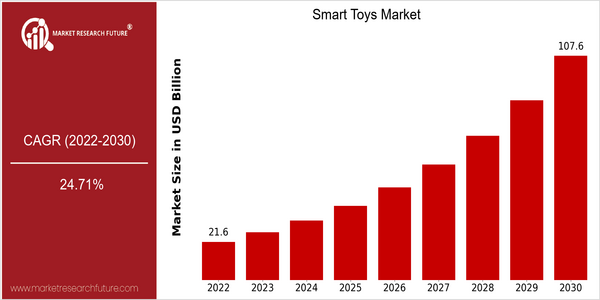

| Year | Value |

|---|---|

| 2022 | USD 21.55 Billion |

| 2030 | USD 107.61 Billion |

| CAGR (2024-2030) | 24.71 % |

Note – Market size depicts the revenue generated over the financial year

The Smart Toys Market has demonstrated significant growth, expanding from a valuation of USD 21.55 billion in 2022 to a projected USD 107.61 billion by 2030. This remarkable increase reflects a compound annual growth rate (CAGR) of 24.71% from 2024 to 2030, indicating a robust upward trajectory in consumer demand and technological advancements. The surge in market size can be attributed to the increasing integration of artificial intelligence, augmented reality, and the Internet of Things (IoT) into toys, enhancing interactivity and educational value for children. Key factors driving this growth include the rising trend of educational toys that promote STEM learning, as well as the growing parental preference for toys that offer both entertainment and developmental benefits. Companies such as LEGO, Hasbro, and Mattel are at the forefront of this innovation, investing in new product lines and strategic partnerships to enhance their offerings. For instance, LEGO's collaboration with technology firms to create interactive building experiences exemplifies the industry's shift towards smart, engaging play. As these trends continue to evolve, the Smart Toys Market is poised for substantial expansion, reflecting broader shifts in consumer behavior and technological capabilities.

Regional Market Size

Regional Deep Dive

The Smart Toys Market is experiencing significant growth across various regions, driven by technological advancements, increasing consumer demand for interactive and educational toys, and a growing emphasis on STEM (Science, Technology, Engineering, and Mathematics) learning. In North America, the market is characterized by high disposable incomes and a strong inclination towards innovative products, while Europe showcases a blend of traditional toy markets with a rising interest in smart technology. The Asia-Pacific region is rapidly emerging as a key player due to its large population and increasing urbanization, whereas the Middle East and Africa are witnessing gradual adoption influenced by changing consumer preferences. Latin America, while still developing, is beginning to embrace smart toys as educational tools, reflecting a shift in parental attitudes towards learning through play.

Europe

- The European market is seeing a surge in eco-friendly smart toys, with companies like LEGO investing in sustainable materials and practices, reflecting a growing consumer preference for environmentally responsible products.

- Government initiatives promoting digital literacy among children are encouraging the adoption of smart toys as educational tools, fostering a culture of learning through technology.

Asia Pacific

- China is becoming a hub for smart toy manufacturing, with companies like Xiaomi launching interactive toys that combine entertainment with educational content, catering to the tech-savvy youth.

- The increasing penetration of smartphones and tablets in households is driving the demand for smart toys that connect to mobile applications, enhancing interactivity and engagement.

Latin America

- In Brazil, local startups are emerging with innovative smart toy concepts that blend traditional play with technology, reflecting a unique cultural approach to learning.

- The increasing internet penetration and smartphone usage in Latin America are paving the way for smart toys that offer interactive experiences, aligning with global trends in educational play.

North America

- The rise of tech giants like Hasbro and Mattel has led to the development of smart toys that integrate AI and augmented reality, enhancing the play experience and educational value for children.

- Regulatory changes in safety standards for electronic toys have prompted manufacturers to innovate while ensuring compliance, leading to safer and more engaging products.

Middle East And Africa

- The introduction of smart toys in the UAE is supported by government programs aimed at enhancing educational outcomes, with initiatives like the Mohammed bin Rashid Innovation Fund promoting tech-driven educational tools.

- Cultural shifts towards valuing education and technology in countries like South Africa are leading to a growing acceptance of smart toys as essential learning aids for children.

Did You Know?

“Did you know that nearly 70% of parents believe that smart toys can significantly enhance their children's learning experiences?” — National Toy Association Survey 2023

Segmental Market Size

The Smart Toys Market is experiencing robust growth, driven by increasing consumer demand for interactive and educational play experiences. Key factors propelling this segment include the rising emphasis on STEM (Science, Technology, Engineering, and Mathematics) education among parents and the integration of advanced technologies such as AI and IoT in toy design. Companies like LEGO and Fisher-Price are at the forefront, developing products that not only entertain but also educate children, enhancing cognitive skills through play. Currently, the adoption of smart toys is in a scaled deployment phase, with notable examples including the use of smart dolls and robotic kits that adapt to children's learning styles. The primary applications of this segment are found in educational settings and at home, where toys like Osmo and Cozmo are utilized to facilitate learning through interactive gameplay. Trends such as the increasing focus on personalized learning experiences and the impact of the COVID-19 pandemic, which has shifted play patterns towards digital engagement, are accelerating growth. Technologies such as augmented reality and machine learning are shaping the evolution of smart toys, making them more engaging and responsive to user interactions.

Future Outlook

The Smart Toys Market is poised for remarkable growth from 2022 to 2030, with a projected market value increase from $21.55 billion to $107.61 billion, reflecting a robust compound annual growth rate (CAGR) of 24.71%. This growth trajectory is driven by the increasing integration of advanced technologies such as artificial intelligence, augmented reality, and the Internet of Things (IoT) into toys, enhancing interactivity and educational value. As parents increasingly seek engaging and educational play experiences for their children, the demand for smart toys that promote cognitive development and social skills is expected to rise significantly. By 2030, it is anticipated that smart toys will penetrate approximately 30% of the global toy market, indicating a substantial shift in consumer preferences towards tech-enabled playthings. Key technological advancements, including improved connectivity and data analytics, will further propel the market. The rise of smart home ecosystems is likely to create synergies with smart toys, allowing for seamless integration into children's daily lives. Additionally, growing awareness of the benefits of STEM (Science, Technology, Engineering, and Mathematics) education will drive demand for toys that foster learning through play. Emerging trends such as personalized play experiences and the incorporation of sustainability in toy manufacturing will also shape the market landscape. As manufacturers innovate to meet these evolving consumer expectations, the Smart Toys Market is set to become a dynamic segment within the broader toy industry, characterized by rapid growth and transformative change.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 21.55 Billion |

| Growth Rate | 24.71% (2022-2030) |

Smart Toys Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.