Smart Hospital Wearables Size

Smart Hospital Wearables Market Growth Projections and Opportunities

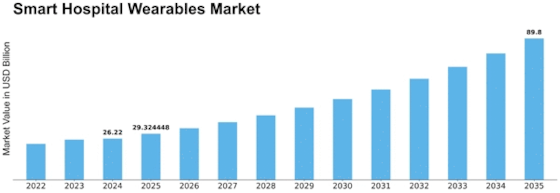

The Smart Hospital Wearables Market is expected to reach USD 58.08 Billion by 2032 at 14.3% CAGR from 2023-2032. The Smart Hospital Wearables Market is booming due to market drivers that are changing medical care. Smart hospital wearables allow doctors to scan patients and make convenient mediations remotely, improving patient outcomes.

Innovation has a major impact on smart hospital wearables. These wearables provide more accurate and meaningful experiences thanks to IoT, computational reasoning, and AI. These innovations improve medical service delivery and patient care.

Personalized medicine has also boosted smart hospital wearables. These devices allow doctors to adapt treatment approaches based on patient data. To redo medical services mediations based on a patient's unique health profile provides appealing and targeted clinical consideration, encouraging hospital interest in smart wearables.

Another important market element affecting smart hospital wearables is cost-viability. By promoting preventative care and early intervention, these wearables can help save medical expenses. Smart wearables prevent costly hospital admissions and entanglements by continuously studying patients and identifying probable medical issues early on, saving medical care providers and patients a lot of money.

Interoperability and data security are also important in smart healthcare wearables. As these devices generate massive amounts of sensitive health data, continuous integration with established medical services frameworks and strong safety initiatives are essential. Partners in the medical services biological system are developing smart wearable interoperability rules and conventions to improve medical treatment.

Buyer awareness and acceptance are shaping the smart healthcare wearables industry. Wearable technologies that allow customers to monitor their health are becoming more popular as people become more health-conscious and proactive. This change in consumer behavior is boosting smart hospital wearables' adoption in clinical settings and daily life, propelling market growth.

Leave a Comment