Smart Grid Security Size

Market Size Snapshot

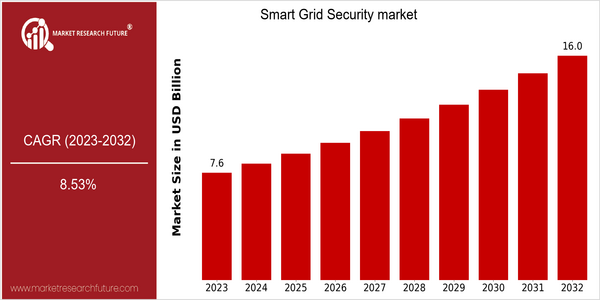

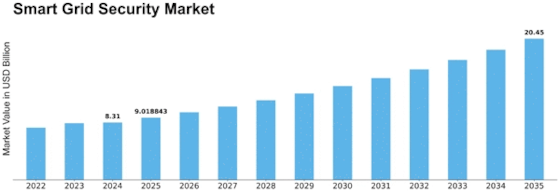

| Year | Value |

|---|---|

| 2023 | USD 7.57 Billion |

| 2032 | USD 16.0 Billion |

| CAGR (2024-2032) | 8.53 % |

Note – Market size depicts the revenue generated over the financial year

The smart grid security market is valued at $ 7.57 billion in 2023 and is projected to reach $ 16 billion by 2032, at a CAGR of 8.53% from 2024 to 2032. This growth is mainly due to the growing importance of cybersecurity in the smart grid technology field. In the smart grid technology field, the integration of digital solutions into energy equipment is becoming more and more common. In order to meet the needs of grid operators and consumers, the use of advanced technology to improve the efficiency and reliability of grid operations has increased. , the need for comprehensive security solutions to prevent cyber attacks has become inevitable. The increasing number of cyber attacks on critical infrastructures, the emergence of regulatory requirements for enhanced security measures, and the increasing use of Internet of Things (IoT) devices in smart grids are driving the development of the market. Artificial intelligence and machine learning are also important. The security solution. The major players in the smart grid security market, such as Siemens, IBM and Cisco, are actively deploying strategic initiatives such as investment and cooperation in the field of cybersecurity to strengthen their market position and meet the increasing demand for smart grid security.

Regional Market Size

Regional Deep Dive

Hence the growing need for the security and resilience of the energy grid. The North American market is characterized by technological progress and regulatory frameworks that are extremely demanding for the security of the grid. Europe is experiencing an upsurge in smart grid investment, driven by the European Union’s commitment to sustainable development and energy efficiency. The Asia-Pacific region is developing rapidly, with China and India investing heavily in smart grids to meet their growing energy needs. Africa and the Middle East are also modernizing their energy sectors, while Latin America is gradually adopting smart grid solutions to improve the distribution and management of energy.

Europe

- The European Union's Green Deal is driving investments in smart grid technologies, with a focus on enhancing cybersecurity to protect renewable energy sources and infrastructure.

- Organizations such as ENTSO-E are collaborating on projects to develop standardized security protocols for smart grids, ensuring interoperability and resilience across member states.

Asia Pacific

- China's State Grid Corporation is implementing advanced security measures in its smart grid projects, aiming to safeguard against increasing cyber threats as the country expands its energy infrastructure.

- India's Smart Grid Mission is promoting the adoption of secure smart grid technologies, with government support for projects that enhance grid reliability and security.

Latin America

- Brazil is investing in smart grid technologies to improve energy distribution, with a focus on implementing security measures to protect against cyber threats.

- Mexico's government is promoting smart grid initiatives that include cybersecurity frameworks, aiming to modernize its energy sector and enhance grid resilience.

North America

- The U.S. Department of Energy has launched initiatives to enhance cybersecurity measures for smart grids, emphasizing the importance of protecting critical infrastructure from cyber threats.

- Major companies like Siemens and General Electric are investing in innovative smart grid security solutions, focusing on integrating AI and machine learning to predict and mitigate potential security breaches.

Middle East And Africa

- The UAE's Energy Strategy 2050 includes plans for smart grid development, with a focus on integrating cybersecurity measures to protect the nation's energy assets.

- South Africa's Department of Energy is exploring partnerships with private companies to enhance smart grid security, addressing challenges related to energy theft and infrastructure vulnerability.

Did You Know?

“Approximately 80% of utility companies in North America have reported experiencing at least one cyber attack on their smart grid systems in the past year.” — U.S. Department of Energy Cybersecurity Report 2023

Segmental Market Size

The smart grid security sector plays a key role in protecting the energy industry’s critical assets and is currently experiencing significant growth. Demand is being driven by increasing cyber threats to energy systems, the implementation of regulatory requirements for enhanced security, and the rapid uptake of smart grid IoT devices. These factors are compelling power companies and other energy suppliers to invest in advanced security solutions to protect their assets and ensure continuity of operations. The smart grid security market is currently moving from the pilot stage to mass deployment, with a number of vendors, including Siemens and Schneider Electric, deploying comprehensive security frameworks in various regions, particularly North America and Europe. Threat detection, incident response and risk management are the key applications, with smart meter security and grid monitoring the main use cases. Meanwhile, the government’s increasing focus on cybersecurity resilience and its drive for greater sustainability are further driving growth. The introduction of new security solutions based on artificial intelligence, big data and blockchain is transforming the sector and enhancing the ability to anticipate and prevent threats.

Future Outlook

The market for smart grid security is expected to grow from US$7.57 billion in 2023 to $16 billion in 2032, a CAGR of 8.53%. This is mainly due to the complexity of the energy system and the increase in the number of cyber-attacks on the energy system. As the grid continues to be modernized, the need for advanced security solutions will increase, which will lead to the penetration of smart grid security technology in different regions. It is expected that by 2032, more than 60% of utility companies will have fully integrated security frameworks into their smart grid operations, compared to about 30% in 2023. Artificial intelligence and machine learning in the field of threat detection and response will play an important role in determining the development trend of the market. Also, the supportive policies and regulations of the national energy security and resilience will also stimulate the development of the market. Also, the trend of the Internet of Things and the emergence of data privacy issues will make the security measures for the smart grid more sophisticated. However, the market will continue to evolve, and all parties need to be aware of the changes in the threat environment and establish a comprehensive and pro-active security strategy.

Leave a Comment