Smart Elevator Size

Smart Elevator Market Growth Projections and Opportunities

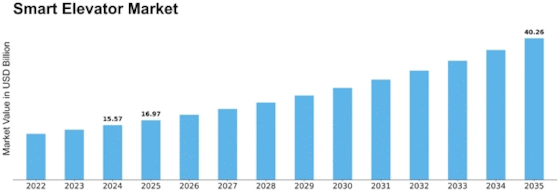

Various market aspects shape the Smart Elevator industry's growth and dynamics. Rising urbanization and population density in large cities globally are primary reasons. As cities grow, smart elevators are needed for efficient vertical transit. These elevators address the issues of high-rise buildings in densely populated metropolitan environments with energy efficiency, real-time monitoring, and predictive maintenance.Smart Elevator Market to reach USD 38.91 billion with 13.54% CAGR by 2030

Advances in technology shape the Smart Elevator market. Internet of Things (IoT), artificial intelligence, and machine learning improve elevator performance. IoT connectivity lets smart elevators collect and analyze data in real time for predictive maintenance and downtime reduction. Artificial intelligence improves elevator operations and user experience by developing more advanced control systems. These technical advances make smart elevators more efficient and appealing to building owners and developers.

Smart Elevator market energy efficiency is crucial. Smart elevators reduce energy use as green construction methods become more popular. Regenerative drives, destination control systems, and energy-efficient materials reduce elevator emissions. As organizations and consumers value sustainability, energy-efficient smart elevator demand will rise, propelling market growth.

Government rules and actions shape the Smart Elevator market. Many governments worldwide are enforcing energy efficiency and construction safety norms. These restrictions are driving building owners and developers to embrace smart elevator solutions to comply and satisfy sustainability goals. Government rebates and incentives for energy-efficient elevator installations boost the industry.

Global economic conditions and construction sector trends affect the Smart Elevator market. Commercial and residential construction rates depend on economic stability and growth. Smart elevator use rises with construction project need for innovative vertical transportation solutions. New architectural concepts like smart buildings and smart cities help integrate smart elevator systems into current infrastructure.

Leading competitors in the Smart Elevator market innovate and launch new products to stay ahead. To compete, market participants use product differentiation, technological developments, and strategic collaborations. Well-established elevator manufacturers and emerging players offering novel solutions create a vibrant market.

Smart Elevator market growth is driven by several factors. Growing urbanization, technical advances, energy efficiency emphasis, government restrictions, economic conditions, and competitive dynamics shape the Smart Elevator industry. Smart elevators will stay in demand as the world urbanises and prioritizes sustainable building practices, making them a major component of the elevator industry.

Leave a Comment