Smart Diapers Size

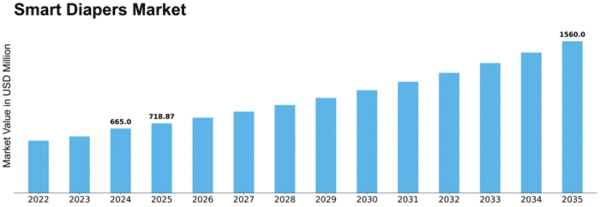

Smart Diapers Market Growth Projections and Opportunities

In the ever-evolving landscape of the Smart Diapers Market, implementing effective market share positioning strategies is crucial for companies aiming to distinguish themselves and thrive in this innovative industry. A fundamental approach involves continuous product innovation and technological advancements. Companies within this market consistently strive to develop smart diapers equipped with cutting-edge features, such as moisture sensors, temperature indicators, and connectivity to mobile apps. These innovations position brands as pioneers in the realm of baby care technology, attracting tech-savvy parents and establishing a foothold in the market. By offering a diverse range of smart diaper solutions, companies can cater to different consumer needs, securing a substantial market share. Understanding and adapting to the changing dynamics of the parenting and baby care industry is another critical aspect of market share positioning in the Smart Diapers Market. Companies conduct market research to identify emerging trends, parental concerns, and preferences related to convenience and health. Aligning their smart diaper offerings with these evolving demands allows brands to position themselves as leaders in specific market niches. For instance, developing eco-friendly and sustainable smart diapers can appeal to environmentally conscious parents, contributing to a competitive advantage and a larger market share. Pricing strategies play a significant role in market share positioning within the Smart Diapers Market. Companies often adopt flexible pricing models based on factors such as technology integration, brand reputation, and the competitive landscape. Offering affordable options with essential smart features can attract price-sensitive consumers, while premium pricing for advanced, high-tech smart diapers can appeal to parents seeking top-notch baby care solutions. Striking the right balance in pricing is crucial for gaining market share and sustaining competitiveness. Effective marketing and branding strategies are vital components of market share positioning in the Smart Diapers Market. Establishing a strong brand identity through targeted marketing campaigns, partnerships with parenting influencers, and clear communication of the benefits of smart diapers can set companies apart from competitors. Brands that effectively convey the convenience, safety, and technological prowess of their smart diapers can build trust among parents, influencing their purchasing decisions and fostering brand loyalty. Distribution channels also play a pivotal role in market share positioning. Companies must ensure that their smart diapers are readily available through various channels, from traditional retailers to online platforms. Establishing strategic partnerships with baby stores, online marketplaces, and healthcare providers contributes to a broader market reach. An optimized supply chain and efficient logistics enhance accessibility, making it easier for parents to choose a particular brand and contributing to increased market share.

Leave a Comment