Top Industry Leaders in the Small Gas Engines Market

*Disclaimer: List of key companies in no particular order

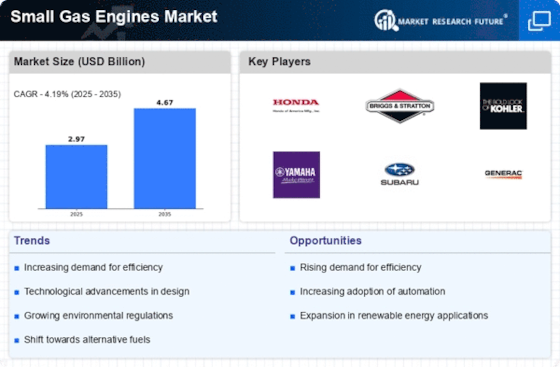

The small gas engine market, propelling a diverse array of equipment from lawnmowers to generators, finds its impetus in factors like surging urbanization, augmented disposable incomes, and an escalating demand for outdoor power tools. Within this dynamic panorama, an intricate tapestry of strategies unfolds among seasoned players and novel entrants, all vying for a coveted slice of the market share.

Key Players and Their Strategies: Strategic Orchestration

Major players shaping the small gas engine market landscape include:

- Briggs and Stratton Corporation

- Honda Motor Co.

- Kohler Co.

- Kawasaki Heavy Industries

- Fuji Heavy Industries

- Yamaha Motor Co.

- Kubota Corporation

- Liquid Combustion Technology LLC.

- Champion Power Equipment

- Fuzhou Launtop M&E Co. Ltd.

- Maruyama Mfg. Co. Inc.

- Lifan Power, and others.

Global Brands: Industry giants such as Briggs & Stratton, Honda, Kohler, and Kawasaki command substantial market share through brand recognition, expansive distribution networks, and unwavering commitment to innovation. Briggs & Stratton's recent acquisition of Generac extends their footprint into the portable generator market, while Honda concentrates on enhancing fuel efficiency and reducing emissions with its GX engines.

Asian Powerhouses: Companies like Loncin, Lifan, and Chinalight Machinery are posing challenges to established players with competitively priced offerings. Their vertically integrated manufacturing and focus on emerging markets position them to offer cost-effective solutions, capturing the attention of budget-conscious consumers.

Specialized Niche Players: Smaller entities find success by carving out niches through a focused approach on specific applications. For instance, Briggs & Stratton's Vanguard engines cater to heavy-duty commercial equipment, and Kohler's PowerMax engines target the high-end residential market. This specialization allows them to command premium prices for superior performance and durability.

Market Share Analysis: Navigating the Metrics

Various factors influence market share analysis in the small gas engine market:

-

Engine Displacement: The 101-400cc segment dominates demand, driven by lawnmowers and gardening equipment. However, segments like 20-100cc are witnessing growth in emerging markets for smaller tools and appliances. -

Application: Presently, lawn and garden equipment takes the lead, followed by construction and industrial applications. Portable generators are poised for growth due to an increasing reliance on backup power. -

Region: North America remains the largest market, yet regions like Asia Pacific and Latin America are expected to witness faster growth due to rising disposable incomes and infrastructure development.

New and Emerging Trends: Charting the Course Forward

Several trends and emerging technologies are shaping the small gas engine market's trajectory:

-

Electrification: While gasoline dominates currently, battery-powered engines are gaining traction due to environmental concerns and noise regulations. Companies like Briggs & Stratton and MTD are making significant investments in electric alternatives. -

Connectivity and Automation: Smart features like remote control and performance monitoring are being seamlessly integrated into engines, creating new revenue streams and enhancing user experiences. -

Sustainability: Manufacturers are focusing on cleaner-burning engines with lower emissions and exploring alternative fuels like propane and natural gas.

Overall Competitive Scenario: Navigating the Landscape

The small gas engine market is witnessing an escalation in competition, with established players feeling the pressure from cost-competitive Asian manufacturers and disruptive innovations in electrification and automation. To stay ahead, companies need to:

-

Invest in R&D: Continuous improvement in engine performance, fuel efficiency, and emissions reduction should remain a top priority, while also exploring alternative technologies. -

Strengthen Distribution Networks: Ensuring product availability and accessibility, particularly in emerging markets, is crucial. -

Adapt to Changing Consumer Preferences: Offering diverse product lines and catering to specific needs in different market segments is essential. -

Embrace Digitalization: Leveraging data analytics and smart features to personalize offerings and enhance customer experience is a strategic move. -

Prioritize Sustainability: Developing cleaner-burning engines and exploring alternative fuels align with environmental regulations and appeal to eco-conscious consumers.

The small gas engine market holds promising growth prospects in the upcoming years. By effectively navigating the evolving competitive landscape and responding to market trends, companies can secure their positions and thrive in this dynamic environment.

Industry Developments and Latest Updates:

Briggs & Stratton:

- Date: December 15, 2023

- Source: Press Release

- Development: Announced a partnership with Kohler Co. to develop and share electric powertrain technology for lawnmowers and other outdoor power equipment. This collaboration could lead to faster and more cost-effective innovation in the electric small engine market.

Kohler Co.:

- Date: December 12, 2023

- Source: Industry Conference Presentation

- Development: Highlighted a commitment to developing a diverse portfolio of powertrain solutions, including gasoline, electric, and hybrid technologies, to meet evolving customer needs and environmental regulations.

Honda Motor Co.:

- Date: December 5, 2023

- Source: Company Website

- Development: Unveiled a new line of high-efficiency GX series four-stroke gasoline engines featuring improved fuel economy and lower emissions. These engines are targeted for professional landscapers and commercial use.

Yamaha Motor Co.:

- Date: September 19, 2023

- Source: Press Release

- Development: Introduced a new line of EF series inverter generators featuring quieter operation and improved fuel efficiency. These generators are targeted for recreational and emergency backup power applications.

Kubota Corporation:

- Date: August 10, 2023

- Source: Investor Presentation

- Development: Emphasized a focus on developing cleaner and more fuel-efficient gasoline engines, while also exploring alternative powertrain technologies such as hydrogen fuel cells.