Slickline Services Size

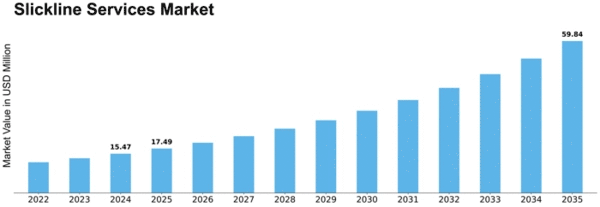

Slickline Services Market Growth Projections and Opportunities

The slickline services engaged in a wider spectrum of the oil and gas industry are highly vital for the well intervention and maintenance operations. Market dynamics in payments sector are constituted of a significant number of factors which basically determine competitiveness of this sector and the services it is providing. By far, the demand for energy worldwide is the principal aspect that fuels exploration and production activities. While the world squeezes itself from oil and gas industries, slickline services are growing proportionately, affirming the demand for them.

Substantial improvement in technology also serves a major contributor in reshaping the market dynamics. Downhole devices and equipment innovations always go hand in hand with the upgrade of exsisting slickline services which enables efficient and reliable solutions to all kinds of oilfield challenges the companies may face. With the growing integration of smart technologies, data analytics and automation, interventions can become more detailed, accurate and cost-sensitive thus ensuring that well production activities are discharged with accuracy, cost-effectiveness and simplicity. This technical evolution is not just about improving operational efficiency but also it reflects the trend of sustainability and ecological responsibility that future of this industry stress a lot on.

Market dynamism also depends on compliances and environmental utilities. As more and more governments around the world coming out with tighter regulations to maintain the utmost safety and environmental protection licences, slickline services companies have to revamp their services and tech so they’re always up to date. Complentation with these regulations not just only guarantees the company its legal standing but also its reputation within the industry which makes people to trust more the clients and stakeholders.

Competition is one of the major forces, influencing the market niche of slick line service providers. The sector by the players who are both the big multinational group of companies and also the little regional service provides. In turn, this creates a heated competition among businesses vying to develop unique technologies, excellent service delivery and innovative processes, which fundamentally brings customer satisfaction and higher competitiveness to the market. Strategic cooperation and consolidation in form of mergers and acquisitions are also among important factors shaping the competitive environment of the market which are used by companies to broaden their service offerings and market presence.

The cyclicality of the oil and gas industry adds another dimension to the interaction of market principles with this industry. Oil price may fluctuate could lead to a limitation in production and exploration that in the end would reducing the demand of slickline services. Low oil prices act as a discouraging factor and enhance the probability of companies investing less in exploration and production, thus low the demand for well intervention and maintenance services provided by the company. On the other hand, during the down turns, business tends to cut costs means that social services might not be part of the priorities.

Leave a Comment