Sizing Thickening Agents Size

Sizing Thickening Agents Growth Projections and Opportunities

The Sizing and Thickening Agents industry is subject to a range of multiple drivers which eventually lead to the dynamics of the market. One of the vital components is the customer demand being more for the convenience and high quality of life in different industries. With the development of industries like food and beverages, cosmetics, and pharmaceuticals, the requirement of high efficiency size and thickening agents at the same time increases. They serve as an important ingredient in making the texture, stability, and other qualities of products, which meet the need of allergen-free people, fine customers.

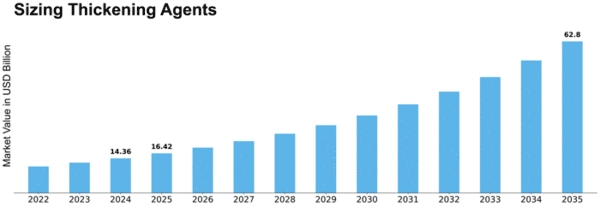

The sizing and thickening agents market is estimated to amount to USD 26.37 billion by 2030 via a CAGR of 7.7% that takes effect during the forecast period from 2022 to 2030.

Additionally, the global trend migration towards healthier lifestyles also impact the sizing and thickening market. The customers today are becoming more health-oriented, thus there is a rise in demand for natural and plant-based products. The change that has occurred empelled manufacturers to be creative and put in natural thickening and sizing agents into their formulations all due to clean label products. This has led the stakeholders to conduct research and development where they come up with new plant based elements that satisfy the desired functionality without any interference on the health aspect.

Moreover, regulatory issues in consumer preferences also affect the market prominently. Within the food, pharmaceuticals, and cosmetics industries, companies must respond to stringent rules concerning the use of specific chemicals and additives by reformulating their products. Therefore, the request for the alternative sizing and thickening materials that are in accordance with the regulatory requirements is also affected by this. Market participants have to manage this complicated regulatory framework to make sure that their products meet the safety and quality norms imposed on the market while remaining popular among consumers.

Additional factors responsible for the changes in the size and density agents market is the economical factors. Factors, including a consumer’s purchasing power, inflation rates, and the general economic conditions, determine the market trends. In economic downturns, consumers might elect to go with more affordable products, then the manufacturers are forced to change either their formulations or their pricing strategies. On the other hand, during periods of economic upturn, customers are likely to be more generous with premium products, thus, there arises a situation where there is a higher demand for high-end sizing and thickening agents.

Important issues for market development are an international supply chain and access to raw materials. Prices and availability of important raw materials - starches, gums, and hydrocolloids - are subject to substantial fluctuations, thus having a negative impact on production costs and, ultimately, product prices. Market participants have to remain alert to changes in the supply chain and turn those adjustments to their advantage to remain competitive.

Leave a Comment