Sintered Steel Size

Sintered Steel Market Growth Projections and Opportunities

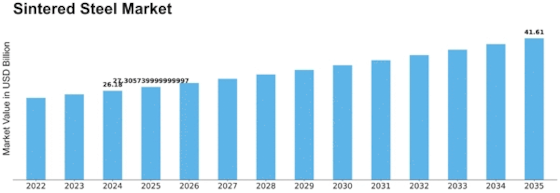

The Sintered Steel Market Size was USD 24.1 Billion in 2022. The Sintered Steel market will Register a CAGR of about 4.30%, and it is estimated to reach USD 35.2 Billion by 2032, starting from an estimation of USD 25.1 Billion in the year 2023. Several factors determine the dynamics of the Sintered Steel Market. Due to its strength, durability, and versatility, sintered steel, which is a powdered metal material made by compressing and heating metal powders, has found numerous applications across diverse industries. It is used extensively in automotive manufacturing, where it produces components such as gears, bushings, and structural parts, thereby being one of the leading driving factors behind this industry's growth rate. Technological advancements significantly influence the market dynamics of Sintered Steel in powder metallurgy. Global manufacturing trends affect the demand for Sintered Steel in the market as well as industrial usage. Sintered steel's demand increases as industries opt for cost-effective solutions without compromising on material performance. Automotive and industrial manufacturing regulations set by governments play a significant role in influencing markets for Sintered steel. Manufacturers must comply with these rules to ensure their products satisfy requirements concerning materials' performance, safety, and environmental impact. Economic indicators like capital investment in industry or general manufacturing activity have implications on a wide range of aspects related to sintered steel. The use of sintered steels across various applications can be attributed to a stable economy accompanied by an intensified focus on investments targeting enhanced manufacturing. Conversely, changes or downturns in industrial activities might lead to fluctuations in production levels as well as material sourcing within these industries. The dynamics of the Sintered Steel market are affected by competition from players within automotive and industrial manufacturing. Companies invest heavily in research to improve the properties of sintered s, teel, thus opening new application areas that are in line with the changing needs of manufacturers. Global trade patterns and logistics affect the Sintered Steel market. The cost and availability of sintered steel may additionally be influenced by factors such as raw material sourcing, manufacturing locations, transportation costs, and global demand for components requiring sintered steel. Environmental matters have a role in impacting the Sintered Steel market. With escalating concerns over sustainability and eco-friendly practices, manufacturers are exploring sintering steps that save energy. There is also an attempt to reduce waste through recycling options for sintered steel. Customer awareness regarding this metal's application in industrial settings has resulted in its growth.

Leave a Comment