Top Industry Leaders in the Single Walled Carbon Nanotube Market

Single-walled carbon nanotubes (SWCNTs), with their mind-boggling properties and endless potential, are weaving a revolution across diverse industries. These microscopic cylinders of pure carbon, a mere one atom thick, boast exceptional strength, conductivity, and thermal stability, making them highly sought-after for applications ranging from electronics and energy to medicine and materials science. Navigating this complex landscape requires strategic finesse and a keen eye for innovation.

Single-walled carbon nanotubes (SWCNTs), with their mind-boggling properties and endless potential, are weaving a revolution across diverse industries. These microscopic cylinders of pure carbon, a mere one atom thick, boast exceptional strength, conductivity, and thermal stability, making them highly sought-after for applications ranging from electronics and energy to medicine and materials science. Navigating this complex landscape requires strategic finesse and a keen eye for innovation.

Strategic Strokes Dominating the Nanocanvas:

-

Product Diversification: Leading players like Mitsubishi Chemical, LG Chem, and Hanwha Nanotech are expanding their SWCNT portfolios, introducing formulations tailored to specific applications. This differentiation caters to niche markets and fosters customer loyalty. -

Vertical Integration: Securing control over critical resources like carbon feedstock and purification technologies is crucial for cost competitiveness and quality control. Companies like CJ Cheiljedang are pursuing vertical integration, optimizing the chain from source to market. -

Technological Advancements: Research and development in scalable and cost-effective SWCNT production methods are vital for unlocking mass market adoption. Samsung Research's recent breakthrough in catalyst-free SWCNT synthesis exemplifies this innovative push. -

Geographic Expansion: Emerging economies like China and India offer immense potential for SWCNT consumption. Companies like Nanotek Instruments and Chengdu Nano Technology are strategically setting up production facilities in these regions to capitalize on the growing demand. -

Sustainability Focus: Environmental concerns surrounding energy-intensive production methods are prompting industry players to develop greener alternatives. Baytubes' initiatives in using renewable energy sources for SWCNT synthesis demonstrate this commitment to greening the nanoworld.

Factors Dictating Market Share and Growth:

-

Brand Reputation and Reliability: Established players like OCSiAl and Nanoholding with proven track records and consistent quality enjoy significant market share. However, agile startups addressing specific applications can carve out their niche. -

Cost Competitiveness: Optimizing production processes and sourcing affordable raw materials are crucial for cost leadership. Asian manufacturers often have an edge due to lower labor costs, but premium brands command higher prices for superior quality and purity. -

Distribution Network and Customer Service: Extensive distribution networks and prompt technical support are essential for building trust and repeat business. Companies like Graphene Nano Ventures excel in this area. -

Regulatory Landscape: Stringent regulations on safety and environmental impact of nanomaterials influence production technologies and market access. Adapting to evolving regulations and developing safe, compliant SWCNTs becomes crucial for market success.

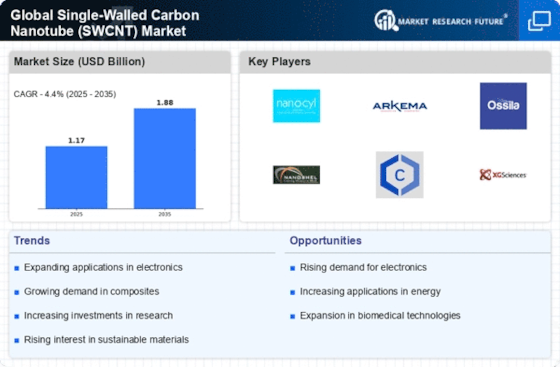

Key Players:

Nanocyl SA (Belgium), SHOWA DENKO K.K. (Japan), Arry International Group Limited (China), Hanwha Chemical Corporation (South Korea), Carbon Solutions, Inc. (U.S.), Thomas Swan & Co. Ltd. (U.K.), OCSiAI (Luxembourg), NanoLab, Inc. (U.S.), Nanoshel LLC (U.S.), KUMHO PETROCHEMICAL. (South Korea), and others.

Industry News and Recent Developments:

August 2023: Mitsubishi Chemical partners with a leading lithium-ion battery manufacturer to develop SWCNT-based electrodes for longer-lasting and faster-charging batteries.

September 2023: LG Chem unveils a novel SWCNT formulation with enhanced thermal conductivity, targeting heat management applications in high-performance electronics.

November 2023: The European Union proposes stricter regulations on nanomaterial safety labeling, posing a challenge for manufacturers but promoting responsible development.

December 2023: Hanwha Nanotech successfully scales up its production of semiconducting SWCNTs, opening doors for next-generation logic circuits and transistors.