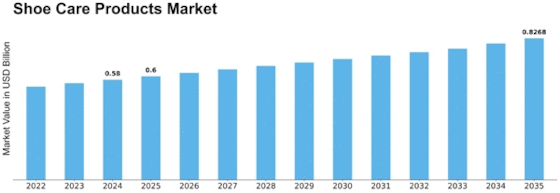

Shoe Care Products Size

Shoe Care Products Market Growth Projections and Opportunities

The shoe care products market is driven by several factors that are shaping its trends and performance in the footwear care industry. A major identification is an increasing consumer’s awareness concerning the value in conserving and preserving their footwear investments. Specialized shoe care products such as cleaners, polishes, protectors, and brushes are highly popular among people who want to maintain their shoes’ aesthetic appeal for a longer period. This innate need for well-kept and clean looking footwear contributes to the ongoing process of growth in market share of shoe care products that meet this dual demand – style coupled with durability. The market for shoe care products is influenced by the demographic factors significantly. Consumers’ preferences for shoe care products depend on age, lifestyle, and footwear tastes. Brands can offer a range of shoe care formulations, applications, and price points by understanding what appeals to its different consumer segments as it caters for the varied demographics in footwear enthusiasts ensuring their market relevance while keeping consumers interested. The market of shoe care products is significantly affected by various economic factors such as disposable income and consumer spending for personal care items. Increased economic stability and free disposable income tend to increase the spending on items that are not necessities such as products related with care of footwear or appearance. Consumers are more likely to purchase higher-end or specialty shoe care items during times of economic prosperity. On the contrary, economic recessions may affect consumer spending on non-essential products which motivates patterns of purchasing in shoe care product segments. Within the shoe care products market, brand image and marketing strategies are key factors influencing consumers’ perceptions. Strong brand loyalty is quite common among shoe care brands which have been established for a long time or are known to produce high-quality, effective and environmentally friendly products. Brand visibility and influence on choices in the competitive market of shoe care products can be generated by effective marketing campaigns which emphasize features such as leather conditioning, color restoration, and eco-friendly formulations. The formulation of shoe care product innovations in terms of technology also adds to the growth rate. Shoe care products have several advanced features that make them more effective, these include quick-drying formulas and water resistance protection; they are also eco-friendly. There are also other technological innovations that help in the appearance of packaging and its applications like user-friendly designs as per modern consumer preferences.

Leave a Comment