Rising Complexity of IT Environments

The increasing complexity of IT environments is a primary driver for the Service Integrators Market. Organizations are adopting diverse technologies, including cloud services, on-premises solutions, and hybrid models. This complexity necessitates the expertise of service integrators to ensure seamless integration and interoperability among various systems. According to recent data, over 70% of enterprises report challenges in managing multi-cloud environments, highlighting the need for specialized integration services. As businesses strive for operational efficiency, the demand for service integrators who can navigate this intricate landscape is likely to grow, thereby propelling the Service Integrators Market forward.

Growing Emphasis on Digital Transformation

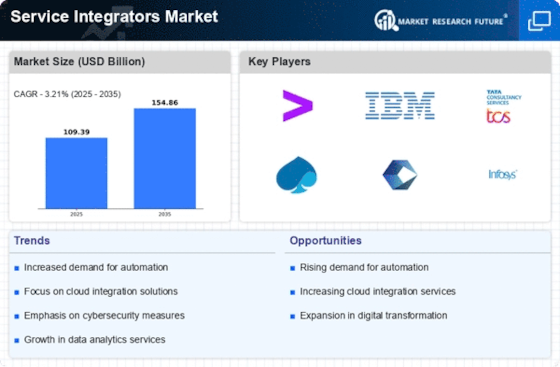

Digital transformation initiatives are reshaping the Service Integrators Market. Organizations are increasingly investing in digital technologies to enhance customer experiences and streamline operations. A report indicates that nearly 60% of companies are prioritizing digital transformation, which often requires the integration of new technologies with existing systems. Service integrators play a crucial role in this process, providing the necessary expertise to facilitate smooth transitions. As businesses seek to leverage data analytics, artificial intelligence, and other digital tools, the demand for service integrators who can effectively manage these integrations is expected to rise, further driving the Service Integrators Market.

Increased Regulatory Compliance Requirements

The evolving landscape of regulatory compliance is a significant driver for the Service Integrators Market. Organizations are facing stringent regulations across various sectors, necessitating robust integration solutions to ensure compliance with data protection and privacy laws. For instance, the implementation of regulations such as GDPR and CCPA has compelled businesses to adopt comprehensive data management strategies. Service integrators are essential in helping organizations navigate these complexities by providing tailored solutions that ensure compliance while maintaining operational efficiency. As regulatory pressures continue to mount, the demand for service integrators who can offer compliant integration solutions is likely to expand, thereby influencing the Service Integrators Market.

Expansion of Internet of Things (IoT) Solutions

The rapid expansion of Internet of Things (IoT) solutions is significantly influencing the Service Integrators Market. As more devices become interconnected, the need for effective integration solutions becomes paramount. Organizations are increasingly deploying IoT technologies to enhance operational efficiency and improve customer engagement. However, integrating these diverse IoT devices with existing systems presents challenges that require specialized knowledge. Service integrators are essential in addressing these challenges, providing the expertise needed to ensure seamless connectivity and data exchange among IoT devices. As the IoT landscape continues to evolve, the demand for service integrators who can facilitate these integrations is expected to grow, thereby driving the Service Integrators Market.

Surge in Demand for Data-Driven Decision Making

The increasing reliance on data-driven decision making is a pivotal driver for the Service Integrators Market. Organizations are recognizing the value of data analytics in informing strategic decisions and enhancing operational performance. As a result, there is a growing need for service integrators who can facilitate the integration of data sources and analytics tools. Recent statistics suggest that over 80% of businesses are investing in data analytics capabilities, which often require complex integrations. Service integrators are positioned to provide the necessary expertise to ensure that data flows seamlessly across systems, thereby supporting the data-driven initiatives of organizations and propelling the Service Integrators Market.