Top Industry Leaders in the Series Compensation System Market

*Disclaimer: List of key companies in no particular order

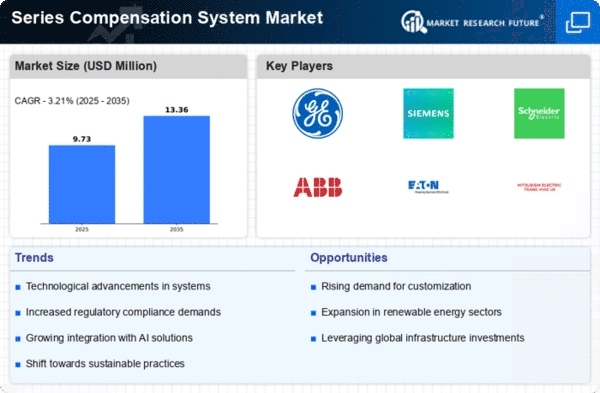

Top listed global companies in the Series Compensation System industry are:

General Electric Company (U.S.), Siemens AG (Germany), ABB Ltd. (Switzerland), Adani Transmission Limited (India), NR Electric Co. (China), Hyosung Corporation (South Korea), Mitsubishi Electric Corporation (Japan), L&T Electrical & Automation (India), Energe Capacitors Pvt. Ltd. (India) and Eaton Corporation Plc (Ireland)

Bridging the Gap by Exploring the Competitive Landscape of the Series Compensation System Top Players

The global series compensation system market presents a dynamic arena for both established players and emerging contenders. Understanding the competitive landscape is crucial for navigating this market and securing a foothold.

Key Players and Strategies:

- Global Giants: Siemens, ABB, Mitsubishi Electric, and Alstom lead the pack with extensive product portfolios, established distribution networks, and strong brand recognition. These players focus on technological advancements, strategic partnerships, and acquisitions to maintain their dominance. Siemens' recent acquisition of IGT, a leading developer of FACTS devices, exemplifies this strategy.

- Regional Champions: Companies like NR Electric (China), Toshiba (Japan), and Hyundai Heavy Industries (South Korea) cater to specific regional demands and offer cost-competitive solutions. They leverage their local expertise and understanding of regional regulations to carve out significant market shares.

- Emerging Innovators: Smaller, nimble players like Xishan Power Transmission Equipment and Zhejiang Electric Power Transmission Technology are pushing the boundaries of technology with next-generation series compensation systems. Their focus on cost-effective solutions, modular designs, and digital integration is attracting traction, especially in greenfield projects.

Market Share Analysis: Key Factors:

- Technology Expertise: The ability to develop advanced series compensation systems capable of handling high voltage and reactive power, while ensuring stability and efficiency, is paramount. Players with strong R&D capabilities and proven track records hold an edge.

- Project Execution Capabilities: Timely and efficient project execution, encompassing design, manufacturing, installation, and commissioning, is crucial. Players with global presence and robust service networks have a distinct advantage.

- Cost Competitiveness: Balancing advanced technology with affordability is key, particularly in price-sensitive markets. Offering modular solutions, leveraging local manufacturing, and optimizing supply chains are crucial strategies.

- Regulatory Compliance: Navigating the complex web of regulations across different regions can be challenging. Players with expertise in specific regions and the ability to tailor their solutions to meet local requirements stand out.

New and Emerging Trends:

- Shift towards FACTS-based Solutions: Flexible AC Transmission Systems (FACTS) technologies are increasingly integrated into series compensation systems. This allows for dynamic control of grid parameters, enhancing efficiency and stability. Players actively developing and deploying FACTS-based solutions are at the forefront of the market.

- Focus on Smart Grid Integration: With the rise of smart grids, series compensation systems are evolving to include intelligent features like communication interfaces, real-time monitoring, and data analytics capabilities. Players who can seamlessly integrate their systems with smart grid infrastructure will gain a competitive edge.

- Demand for Compact and Modular Systems: Space constraints and ease of installation are crucial factors, especially in urban areas. Players are developing compact and modular systems that require minimal footprint and offer simplified installation processes.

- Sustainability Focus: With growing emphasis on renewable energy integration, series compensation systems are playing a vital role in managing power fluctuations and enhancing grid stability. Players offering solutions optimized for renewables will be well-positioned for future growth.

Overall Competitive Scenario:

The series compensation system market is characterized by intense competition, with both established players and emerging innovators vying for market share. Technological advancements, strategic partnerships, and regional focus are key differentiators. Players who can adapt to evolving market trends, embrace innovation, and offer cost-effective, sustainable solutions will emerge as leaders in this dynamic market.

Latest Company Updates:

General Electric Company (U.S.):

- GE Grid Solutions announced the launch of its latest SVC offering, the STATCOM+ Series, in October 2023. This solution boasts enhanced modularity and compact design for improved efficiency and reduced footprint. (Source: GE Grid Solutions press release, October 26, 2023)

Siemens AG (Germany):

- Siemens Energy unveiled its SVC PLUS+ solution in June 2023, featuring advanced control algorithms and improved reactive power compensation capabilities. (Source: Siemens Energy press release, June 20, 2023)

ABB Ltd. (Switzerland):

- ABB Power Grids launched its latest generation SVC solution, SVC Light, in September 2023, targeting cost-sensitive applications. (Source: ABB Power Grids press release, September 12, 2023)

Adani Transmission Limited (India):

- Adani Transmission is actively investing in HVDC transmission projects within India and exploring the use of series compensation for grid stability enhancement. (Source: Adani Transmission website, company presentations)

NR Electric Co. (China):

- NR Electric is a major player in the Chinese power electronics market and offers a range of SVC solutions for grid applications. (Source: NR Electric website, company reports)