Rising Cybersecurity Threats

The escalating threats posed by cyberattacks are a significant driver for the Sensitive Data Discovery Market. As organizations face an increasing number of data breaches and cyber incidents, the need for robust data protection measures becomes paramount. Sensitive data discovery solutions play a vital role in identifying and securing sensitive information, thereby mitigating the risks associated with cyber threats. Market data indicates that the cybersecurity market is expected to reach over 300 billion dollars by 2025, with a substantial portion of this growth attributed to the demand for data discovery tools. Organizations are likely to prioritize investments in sensitive data discovery solutions as part of their broader cybersecurity strategies, further fueling the growth of the industry.

Regulatory Compliance Pressure

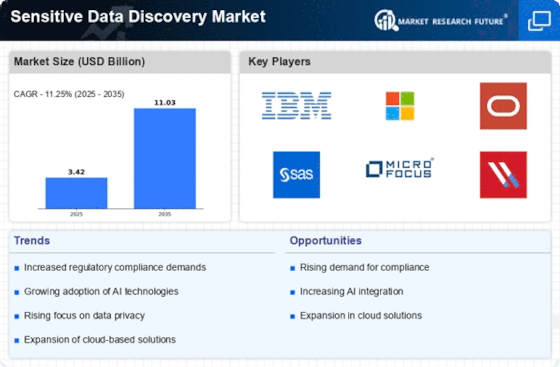

The increasing emphasis on regulatory compliance is a primary driver for the Sensitive Data Discovery Market. Organizations are compelled to adhere to stringent regulations such as GDPR, HIPAA, and CCPA, which mandate the protection of sensitive data. Non-compliance can lead to severe penalties, thus prompting businesses to invest in sensitive data discovery solutions. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is largely attributed to the need for organizations to ensure compliance and mitigate risks associated with data breaches. As regulations evolve, the demand for effective sensitive data discovery tools will likely intensify, making compliance a critical driver in the industry.

Increased Focus on Data Governance

The heightened focus on data governance is a crucial driver for the Sensitive Data Discovery Market. Organizations are recognizing the importance of establishing robust data governance frameworks to manage sensitive information effectively. This focus is driven by the need to ensure data integrity, security, and compliance with regulations. As businesses strive to implement comprehensive data governance strategies, the demand for sensitive data discovery solutions is expected to increase. Market analysts suggest that organizations investing in data governance initiatives are likely to allocate a significant portion of their budgets to sensitive data discovery tools. This trend indicates a growing recognition of the role that effective data governance plays in safeguarding sensitive information and maintaining compliance.

AI and Machine Learning Integration

The integration of artificial intelligence and machine learning technologies is transforming the Sensitive Data Discovery Market. These advanced technologies enhance the capabilities of data discovery tools, enabling organizations to identify and classify sensitive data more efficiently. AI algorithms can analyze vast amounts of data, uncovering patterns and anomalies that may indicate the presence of sensitive information. This technological advancement is expected to drive market growth, with projections indicating that AI-driven solutions could account for a significant portion of the market by 2026. As organizations increasingly recognize the value of AI in data management, the demand for sensitive data discovery solutions that leverage these technologies is likely to rise, further propelling the industry forward.

Growing Data Volumes and Complexity

The exponential growth of data volumes and the increasing complexity of data environments are driving the Sensitive Data Discovery Market. Organizations are generating vast amounts of data from various sources, including cloud services, IoT devices, and social media. This complexity makes it challenging to manage and protect sensitive information effectively. Sensitive data discovery solutions are essential for organizations to navigate this intricate landscape, enabling them to identify and classify sensitive data across diverse environments. Market trends suggest that the demand for data discovery tools will continue to rise as organizations seek to harness the value of their data while ensuring compliance and security. This growing complexity in data management is likely to be a key factor influencing the industry's trajectory.