Semi Trailer Size

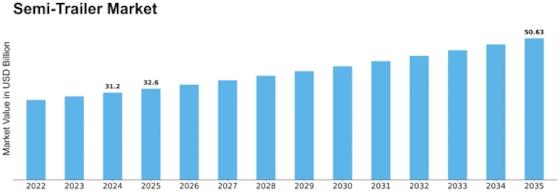

Semi-Trailer Market Growth Projections and Opportunities

Semi-trailers are extensively used without front pivots. The growing virus chain sector and the use of cutting-edge technologies like telematics and reliability control are driving the semi-trailer market. The viral chain sector has grown because of big supermarket commerce. Modern devices like temperature recorders with GSM modems and remote temperature monitoring in refrigerated trailers let trailer owners and supervisors inspect the trailer, boosting market development.The semi-trailer market is multi-layered, shaped by supply, demand, and industry expansion. Semi-trailers, critical transportation and operational pieces, fluctuate according to several factors. Global finance is a key factor. As modernization and globalization increase freight transport needs, semi-trailer demand is challenged by economics. Thus, semi-trailer market aspects depend on financial growth.

Additionally, administrative actions and natural disasters drive semi-trailer industry growth. Producers must promote trailers that meet stricter outflow and wellness criteria as states enforce them. The focus on eco-friendliness and natural maintainability has led to semi-trailer innovations including simplified layouts and lightweight materials to boost efficiency and reduce carbon emissions.

Another factor shaping semi-trailer markets is internet business blasts. The rise of online retail and the need for last-mile transportation services have increased the need for a comprehensive transportation company. This company relies on semi-trailers to produce products from distribution to complaints. As clients embrace online buying, demand for semi-trailers for internet business coordinated operations should rise.

Mechanical advancements boost security, availability, and efficiency, adding to market aspects. Telematics and IoT (Web of Things) provide semi-trailer tracking, monitoring, and prediction. Armada administrators can simplify courses, schedule support, and secure freight and vehicles. These mechanical innovations improve functional competence and align with other transportation industry digitization trends.

Semi-trailer market factors are influenced by cost. Creation, maintenance, and activity costs directly affect semi-trailer value. Makers are always exploring for methods to enhance manufacturing processes, materials, and smart layouts without compromising quality. This cost-conscious approach appeals to armada administrators and coordinated factors groups seeking reliable semi-trailers.

Leave a Comment