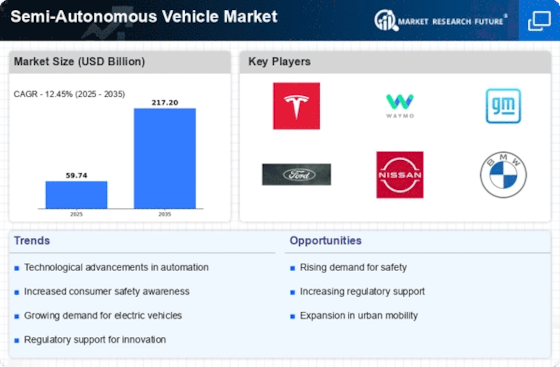

Top Industry Leaders in the Semi Autonomous Vehicle Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Key Player Strategies:

Traditional Automakers: Established brands like Mercedes-Benz, BMW, and Toyota are leveraging their extensive manufacturing and distribution networks to introduce SAV features across their premium and luxury car segments. They emphasize driver assistance systems (ADAS) like adaptive cruise control, lane departure warning, and automatic emergency braking.

Technology Giants: Google's Waymo and Baidu's Apollo are frontrunners in developing Level 4 and 5 autonomous driving systems, targeting robotaxi services and fleet management. They are partnering with automakers and city governments to pilot self-driving programs and gather data for further refinement.

Startups: Agile startups like Cruise (backed by GM) and Argo AI (backed by Ford) are focusing on specific aspects of SAV technology, such as sensor fusion, mapping, and decision-making algorithms. They aim to collaborate with established players or offer their technology as licensing solutions.

Factors for Market Share Analysis:

Level of Automation: The market is segmented into L1 (basic ADAS), L2 (partial automation), and L3 (conditional automation) vehicles. Currently, L2 holds the largest share, but L3 is expected to witness the fastest growth due to its advanced capabilities.

Regional Variations: North America dominates the market with high consumer demand and supportive regulations. However, Asia-Pacific is predicted to be the fastest-growing region due to its large population base and rapid technological advancements.

Technology Partnerships: Collaboration between automakers, tech companies, and startups is crucial for rapid development and cost optimization. Strategic partnerships will play a significant role in shaping the competitive landscape.

New and Emerging Trends:

Focus on Sensor Fusion: LiDAR, radar, and camera technologies are evolving rapidly, and their effective integration through sensor fusion algorithms is critical for robust perception and decision-making.

Cybersecurity Concerns: Ensuring data security and preventing cyberattacks in connected vehicles is paramount. Companies are investing heavily in cybersecurity measures to build trust and mitigate risks.

Personalization and Customization: Consumers are demanding tailor-made driving experiences with adjustable levels of automation and personalized ADAS features. Manufacturers are incorporating AI and machine learning to cater to individual preferences.

Overall Competitive Scenario:

The SAV market is characterized by intense competition with diverse players vying for dominance. While traditional automakers hold an initial advantage, tech giants and startups are bringing disruptive innovations and challenging established norms. The race for Level 4 and 5 autonomy will further intensify competition, leading to potential mergers, acquisitions, and strategic partnerships. Ultimately, the winners will be those who effectively balance technological advancements, strong partnerships, and consumer-centric solutions.

Additional Points:

The role of government regulations and infrastructure development in shaping market growth cannot be ignored.

Sustainability considerations are gaining traction, with electric and hybrid SAVs becoming increasingly popular.

Ethical questions surrounding liability and safety in autonomous driving need to be addressed collaboratively.

In conclusion, the semi-autonomous vehicle market is a thrilling battlefield where established players and new entrants collide. The key to success lies in embracing innovation, forging strategic partnerships, and prioritizing factors like safety, personalization, and ethical considerations. Only then can players truly steer their way towards a dominant position in this transformative landscape.

Daimler AG (Germany):

• October 26, 2023: Announced partnership with Qualcomm to develop next-generation Level 4 autonomous driving system (Source: Reuters).

Continental AG (Germany):

• November 15, 2023: Acquired AI startup, Recogni, to boost self-driving software development (Source: TechCrunch).

Valeo (France):

• October 20, 2023: Launched Level 2+ autonomous driving system for commercial vehicles in Europe (Source: Valeo press release).

ZF Friedrichshafen AG (Germany):

• September 12, 2023: Unveiled new LiDAR sensor technology for autonomous vehicles (Source: ZF press release).

Tesla (US):

• October 24, 2023: Expanded Full Self-Driving (FSD) Beta program to 1 million users (Source: Electrek).

Magna International (Canada):

• November 07, 2023: Secured $3.3 billion contract to supply electric drive systems for robotaxis (Source: The Globe and Mail).

Top listed global companies in the industry are:

Daimler AG (Germany),

Continental AG (Germany),

Valeo (France),

ZF Friedrichshafen AG (Germany),

Tesla (US),

Magna International (Canada),

Waymo LLC (US),

BMW (Germany),

Texas Instruments (US),

Mercedes-Benz (Germany),

General Motors (US),

Audi AG (Germany),

NXP Semiconductor (the Netherland).