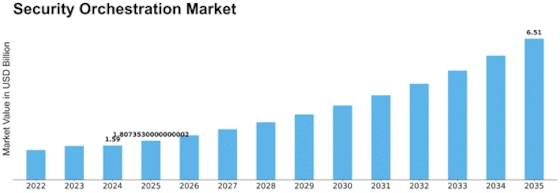

Security Orchestration Size

Security Orchestration Market Growth Projections and Opportunities

Numerous important market drivers shape the growth and dynamics of the Security Orchestration industry. The growing number and complexity of cyberthreats that enterprises must deal with is one of the main factors propelling this industry. Businesses are looking for complete security orchestration solutions to efficiently respond to and prevent complex cyberattacks as the threat landscape keeps changing. The need for security orchestration platforms and solutions has increased due to the focus on automating incident response procedures and managing a variety of security technologies. This has led to the market's expansion across a number of industrial verticals. Furthermore, the market for security orchestration has been greatly impacted by the lack of cybersecurity talent and the requirement for operational efficiency. Organizations are using security orchestration technologies to automate repetitive processes, improve the skills of current security teams, and streamline security operations in response to a global scarcity of qualified cybersecurity professionals. As companies look to increase the effectiveness of security operations and employ orchestration to close the skills gap in cybersecurity, the market has grown. The need for security orchestration has also been fueled by the growth of hybrid IT environments and the rising use of cloud-based security solutions. SaaS (Software as a Service) apps, cloud services, and hybrid infrastructure models are being adopted by enterprises, and this has made centralized security orchestration and coordination across several environments essential. The market has grown as a result of the popularity of security orchestration solutions that provide cross-platform visibility, API-driven automation, and smooth connection with cloud security products. Additionally, the security orchestration market has been significantly shaped by the changing regulatory environment and compliance needs. Organizations are required by industry standards, privacy legislation, and data protection requirements to put strong security controls, incident response protocols, and compliance reporting methods in place. Driven by the necessity to meet legal obligations and guarantee efficient security governance, security orchestration solutions that facilitate standardized incident response workflows, audit trails, and compliance automation capabilities have witnessed an increase in use. Furthermore, the need for security orchestration solutions has been fueled by the diversity of security tools and technologies as well as the increasing complexity of IT infrastructure. Network security appliances, endpoint protection solutions, threat intelligence feeds, and security information and event management (SIEM) systems are all so commonplace that enterprises are finding it difficult to coordinate and integrate these various security technologies. Security orchestration platforms that facilitate workflow automation, interoperability, and integration with various security solutions have become indispensable for enterprises looking to optimize their security operations, hence propelling market growth. The market for security orchestration has also been impacted by the growing emphasis on proactive security measures and threat intelligence. To proactively identify and eliminate security risks, businesses are placing a high priority on threat detection, incident response automation, and threat hunting capabilities. The need to support proactive security measures and improve threat visibility has led to the rise in popularity of security orchestration solutions that facilitate the ingestion of threat intelligence feeds, automated threat analysis, and playbook-driven response actions, which in turn has contributed to the market's growth.

Leave a Comment