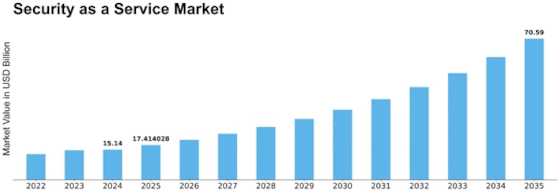

Security As A Service Size

Security as a Service Market Growth Projections and Opportunities

The growth of Security as a Service (SECaaS) market is significantly impacted by a several critical factors. The growing complexity and diversity of cyberthreats to enterprises is one of the main factors propelling the market growth. Businesses are looking for all-inclusive security solutions with advanced threat detection, incident response, and regulatory compliance capabilities as the threat keeps changing. The focus on contracting out security operations to specialized service providers has increased demand for Security as a Service (SaaS) products and accelerated the market's growth across a number of market sectors. Moreover, the SECaaS market is impacted by the increasing use of cloud computing and the inclination toward remote work. Organizations are prioritizing security solutions that can safeguard endpoints across remote access, protect distributed assets, and offer centralized visibility and control. Owing to the widespread use of cloud-based infrastructure, SaaS applications, and remote work environments, the demand for advanced technology is booming. The necessity to handle the security issues associated with cloud and remote work arrangements has increased demand for SECaaS technologies, which offer advanced features such as cloud-native security solutions, secure access controls, and threat intelligence services. This has led to the market's expansion. The key factor driving market growtg have also included the scarcity of cybersecurity personnel and the growing intricacy of security operations. Businesses are looking to SECaaS platforms that offer help in managing security tools, acquire specialist expertise, and enhance their security capabilities as it is difficult to attract and retain experienced cybersecurity professionals. The market is witness its robust adoption as businesses want to fill the skills gap in cybersecurity and use the knowledge and resources provided by SECaaS providers to strengthen their security posture and resilience. The changing regulatory environment and compliance requirements have also had a significant impact on the development of the SECaaS market. Organizations must adhere to tight security demands and secure sensitive data, as mandated by privacy laws, market-specific standards, and data protection legislation. Driven by the need to meet compliance obligations and address the strict security requirements imposed by regulations, SECaaS solutions that provide regulatory compliance assistance, data encryption, and secure access controls have gained traction and are impacting the market's growth.

Leave a Comment