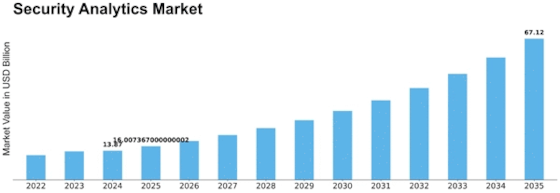

Security Analytics Size

Security Analytics Market Growth Projections and Opportunities

The diverse and frequently overlapping professional domains have a tremendous impact on the trajectory of Security Analytics market. The changing environment is the most important factor. With the increasing sophistication and diversity of cyber threats, businesses have to invest in cutting edge security analytics engines capable of spotting potential risks. The increasing nature and impact of cyberattacks has made security analytics an integral part of a tough-minded strategy on information security. But technical developments also influence the shape of market there is for Security Analytics.

As technologies like artificial intelligence, machine learning and big data analytics are never standing still in their continuous development, so security analytic solutions have become better able to identify threats quickly as they emerge. These technologies are the talk of organizations, many eagerly trying to get ahead of their cyber adversaries with solutions that incorporate these approaches. Another important market factor is regulatory compliance. With governments around the world establishing stricter cybersecurity regulations to protect data and critical infrastructure, many of which also apply to industry regulatory bodies in fields such as telecommunications. As a result, organizations have been eagerly investing in security analytics to ensure they stay on the right side of these regulations and avoid legal complications.

The Security Analytics market is affected also by considerations of cost. Of course, organizations invest in cybersecurity because it is important. But at the same time they have to keep their budgets balanced out. These security analytics solutions that provide a more cost-effective, focused approach to threat detection might stand the best chance for taking market share. Technologies that offer demonstrable return on investment as well as the ability to grow and expand will thrive. In addition, people's factor is important in the Security Analytics market. the lack of skilled cybersecurity personnel has caused headaches for organizations over time.

Products that automatically perform routine functions, such as security analytics solutions capable of offering actionable insights and reducing the burden on cybersecurity teams, are highly rated. Graphical interfaces with easily understood displays add to the implementability of security analytics, allowing them to be more readily used by a wider range of professionals.

Leave a Comment