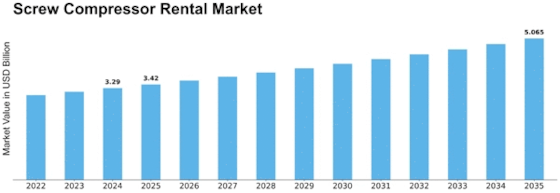

Screw Compressor Rental Size

Screw Compressor Rental Market Growth Projections and Opportunities

Several market factors condition the dynamics of the screw compressor rental market. A major determining factor is the industrial environment, where the compressed air demand plays an essential role. Heavy industries like the manufacturing, construction and oil & gas use a variety of screw compressors for various applications. The amount of industrial activity determines the demand for compressed air, which in turn influences a lot the need for screw compressor rentals. Also, economic situations and changes play an very important role in the tidal wave of this market. In times of economic boom, the industries widen their operations thereby causing a high demand for compressed air solutions. Alternatively, the decline in the economy may force businesses to opt for cheaper alternatives as well such as renting of screw compressors instead of making a hefty capital outlay by buying equipment. Thus, the economic factors and trends are very important indicators in determining the screw compressor rental market. Technological developments also play a very significant role in the market. With the ongoing advancements in the screw compressor technology, newer and more efficient models of these devices are being made available. These innovations improve the efficiency, energy use and reliability of screw compressors usually. Companies that require compressed air solutions can opt to rent the latest models in order to enjoy these advances while also avoiding a long-term investment. As such, the speed at which technological advancement occurs has a major influence on the competitiveness of the screw compressor rental market. Another very important factor is the environmental regulations and sustainability initiatives. With governments of the world tightening regulations in order to lower carbon emissions and promote eco-friendly ways, businesses are being forced into going green. Motivated by complying with the environmental standards, screw compressors, which are energy efficient in their operation, become an attractive option for businesses. The increasing focus on sustainability has a direct relationship with the need to rent out screw compressors, as many companies strive for eco-friendly solutions that satisfy their compressed air requirements. The environment of the screw compressor rental market is very defined by the market competition and also key players, among other factors. A competitive advantage is enjoyed by well-established companies that have a big service network throughout the country and a wide array of rental equipment. They can serve the diverse industries with end-to-end solutions, impacting the market dynamics in its entirety. Other factors that influence the competitive landscape include market consolidation, mergers and acquisitions impacting pricing as well as service offerings for screw compressor rental.

Leave a Comment